Company Analysis: MTR Group FY2025

The new home is on fire...

Key findings: MTR delivered 210bps gross margin expansion to 20.0% on essentially flat revenue, with mix shift toward consumer sales via 4Gadgets offsetting tight Samsung wholesale margins - but the £9.5m owed by distressed parent Exertis clouds an otherwise healthy picture.

Somewhere in the chaos that exists between Christmas and the kids going back to school, MTR Group filed their FY2025 accounts for the year ended 31st March 2025. Back in November 2024, I suggested it was time that MTR Group found another home1. But alas, no white knight intervened before the last of the “five good emperors” came along wielding their parazonium to carve out and cut up MTR’s parent, Exertis.

In summary, Tim Griffin, who signed off the Exertis accounts in October 2025 is no longer with the business, suppliers and supply chain insurers have taken flight, 1000 people, equivalent to 70% of the Exertis (UK) Ltd workforce were put at risk2, and the deflective response from Harald Kinzler, Head of Communications at Aurelius, did nothing to suggest the outcome wasn’t already decided: “A 45-day consultation has started, and no jobs will go until the end of that period by law,” he said. Jesus. “How many jobs will or will not go cannot be decided until the consultation has concluded, and the process will run until late January.” Christ.

It was then reported that Aurelius is trying to sell off the Supplies and AV units and looking to save viable parts of the business3. Well, there are plenty of better owners for MTR Group which now sits under Exertis Ireland Holdings Limited, and outside the current UK restructuring entirely. Let’s take a look…

Recap

MTR Group was incorporated in 2011 as a refurbisher and reverse‑logistics specialist for mobile devices, building expertise in repair, data‑wipe and resale of smartphones, tablets and wearables. The company was acquired by Exertis / DCC Plc in 2017 with the deal positioned as a move into lifecycle management and second‑life devices rather than pure box‑shifting distribution4.

According to their accounts, all of MTR’s revenues are derived from the “sale of used and refurbished mobile phones”. I assume revenues come from tablets, laptops and smartwatches as well, which are acquired through a number of trade-in partnerships, including: Samsung, AO.com (until recently) and Very. Additionally, MTR operates the site 4Gadgets.co.uk, which offers refurbished devices for sale and a trade-in facility directly to consumers.

Whilst MTR’s manufacturer accreditation has historically focused on Samsung, in April 2025 Exertis announced the acquisition of Apple authorised service provider Group 8, widening their circular economy offering5. Regardless of current events, that thesis still stands despite there being no public announcements on rolling up the new capabilities.

Performance

FY2025 Key Metrics:

- Revenue: £43.8m (FY2024: £42.6m, +2.7%)

- Gross Profit: £8.75m at 20.0% margin (FY2024: £7.62m at 17.9%)

- Operating Profit: £1.22m at 2.79% margin (FY2024: £0.93m at 2.18%)

- Net Profit: £1.10m at 2.5% margin (FY2024: £0.91m at 2.1%)

- Cash: £3.81m (FY2024: £2.82m)

- Inventory: £11.64m / 121 days (FY2024: £8.18m / 85 days)

- Employees: 84 generating £521k revenue per head (FY2024: 77 at £553k)

Source: MTR Group Limited (07839241) filed accounts for year ending 31 March 2025

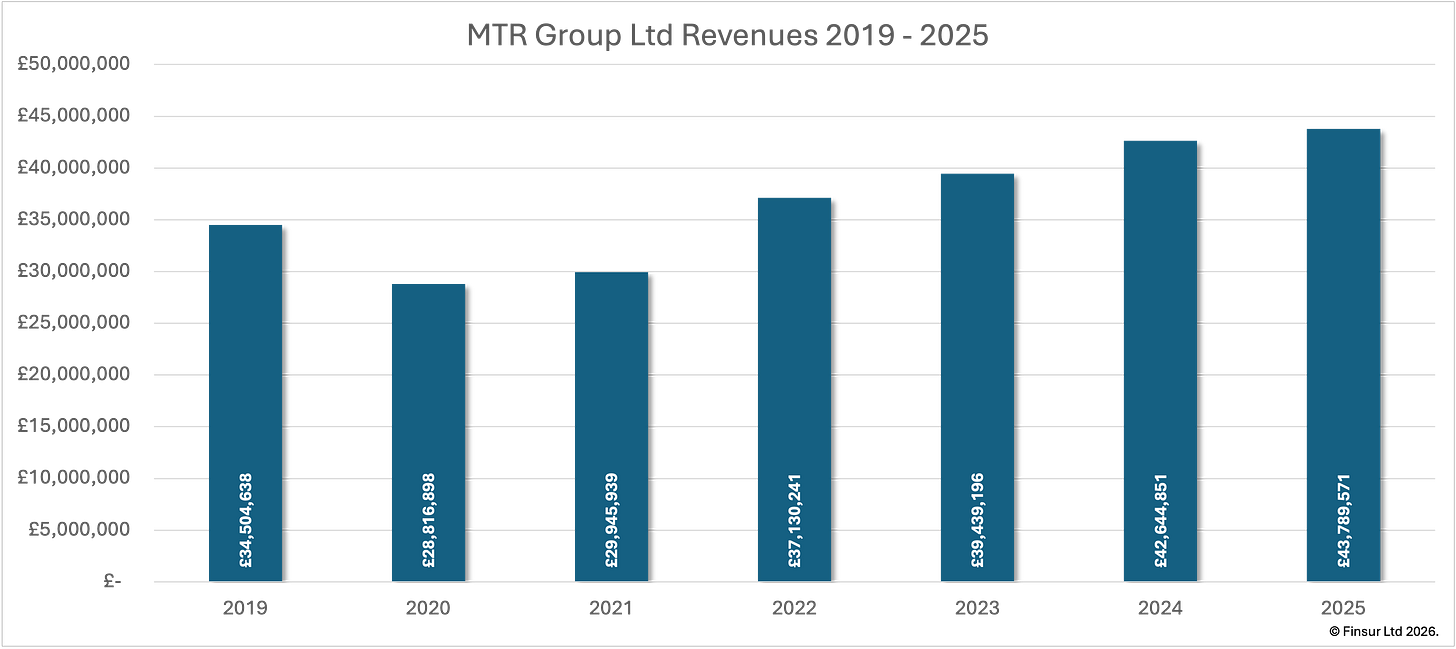

MTR Group reported revenues of £43.8m for FY2025 up 2.7% (FY2024: £42.6m). This marks six consecutive years of growth since the trough of £28.8m in FY2020 at the beginning of COVID. However, the revenue growth rate has slowed considerably from 8.1% in FY2024 and 6.2% in FY2023. Management attribute the revenue increase to the developing Samsung relationship, their main supplier of second-hand devices and growth from their consumer website 4Gadgets.co.uk.

Given that MTR operates Samsung’s trade-in programme, the attribution is interesting. According to Samsung’s trade-in terms and conditions, ownership of the traded-in device transfers from the consumer to MTR. However, whilst MTR historically provided the portal and I assume pricing, this now appears to be run on Samsung’s tech stack meaning that Samsung now appear to control the trade-in value and will therefore have full visibility of MTR’s acquisition costs, effectively making MTR a captive processor with far less control over margin and further subject to the successes of Samsung’s new device sales and trade-in uptake. Regular readers will note this as another indicator of manufacturers generally increasing control over the secondary market, albeit indirectly.

Management are right therefore to highlight the growth from their consumer website and a quick scan of their website suggests they might have some pricing advantage against the market when it comes to Samsung devices. Although, and this is purely anecdotal, it looks like Samsung might be picking off some of the more popular devices for their own programmes, given some product variation restrictions. But, despite the aggressive competition in direct sales, management can at least source and price independently, which will be vital now that it appears ao.com trade in has finally reverted to MusicMagpie’s trade-in process.

Continue reading for:

How a 210bps gross margin expansion on flat COGS reveals the real profit driver

Unit economics breakdown: why Samsung keeps the lights on but 4Gadgets puts food on the table

The 42% inventory build - strategic positioning or captive processor problem?

£9.5m of MTR’s cash trapped in a distressed parent - and what that means for FY2026

Four strategic options from hold and harvest to Samsung vertical integration

Why MTR might be worth more as a cash cow than a sale

Alternatively, to download the report as a licensed PDF, click here