Foxway Research Update: Q2 2025

Bonds into bondage anyone?

I was entirely disappointed this week to find out that I have common ground with Trump. Although, as much as I’d like to have nothing in common whatsoever, I’m sure a dislike of quarterly reporting isn’t actually that rare1. In my first Foxway report2 the erraticism of their quarterly revenue, compounded by segment reporting, deflected from the overall growth. However, the volatility persisted into Q4 2024 with headwinds continuing in Q1 2025. So, despite my quarterly reporting reluctance, I’ll justify this article on the basis that it was the half year report released at the end of August. That, and previous news items were not especially positive, at least as far as the numbers went3.

Recap

Foxway operate three reporting segments: Circular Workspace Solutions (CWS) providing device-as-a-service solutions for workspace equipment to mid/large corporates and the public sector in the Nordics; Recommerce Mobile providing trade-in solutions and asset recovery services for smartphones, focusing on mobile operators, retailers and partners, and; Recommerce Computers & Enterprise (C&E) handling computers, business equipment and network products sourced from OEMs, financing companies, data-centres and resellers.

Whilst Q1 2025 had offered some encouraging signals, including CWS contract signings that exceeded the entire value secured in 2024 and strong sourcing ahead of the Galaxy S25 launch, negative operating cash flow of SEK 247.8 million (€21.3 million) highlighted the working capital intensity that continues to challenge the business model. With Nordic Capital's transformation programme now 18 months into execution, it feels like Q2 could represent a critical test of whether management can convert strategic initiatives into sustainable financial performance amidst the persistent market headwinds, a phrase in which I’ll presume to include tough competition.

Performance

The half-year picture reinforces the challenging dynamic, with net sales down 7.0% year-on-year to SEK 3,587.6 million (€308.6 million) against H1 2024: SEK 3,859.1 million (€332.0 million). On a constant currency basis, the H1 decline of 5.3% demonstrates that headwinds have persisted throughout the first half, countering the cautious optimism expressed in Q1 that conditions might stabilise. The deterioration from Q1's 5.3% decline to Q2's 8.6% contraction demonstrates business conditions worsened during the spring period. Segmental analysis further exposes the performance volatility that has characterised Foxway's recent results, though with differing intensities.

CWS recorded the smallest revenue decline at 6.8% to SEK 549.8 million (€47.3 million) vs. Q2 2024: SEK 589.6 million (€50.7 million). The decline was primarily driven by lower ITAD device volumes and first lifecycle devices, compounded by the lingering impact of a customer loss and extended IT replacement freezes affecting several clients. Management's commentary indicates that whilst new contract signings in Q1 exceeded the entire 2024 total, revenue contribution from these deals remains limited with meaningful impact expected only from August/September onwards. EBITDA contribution will be even further behind.

Recommerce Mobile experienced the steepest decline, falling 12.7% to SEK 746.1 million (€64.2 million) from Q2 2024: SEK 855.1 million (€73.5 million). The segment was affected by more moderate device inflows compared to Q1's substantial Samsung trade-in, whilst Apple device sourcing remained challenging due to competitive market prices for popular models. By quarter-end, Samsung inventory had normalised following the sell-through of earlier stock accumulation, but the expected broader market rebound failed to materialise at the pace witnessed in the comparable 2024 period. Post the results release, Recommerce Mobile saw leadership transition with Kent Jeppesen stepping in after the departure of Mikkel Frid after nearly seven years with the company4.

Recommerce C&E delivered the most resilient performance with a 5.7% decline to SEK 582.1 million (€50.1 million) from Q2 2024: SEK 617.3 million (€53.1 million). This segment faced headwinds from an exceptionally strong overstock comparison base in April 2024, yet managed to maintain some momentum through robust enterprise equipment sales, particularly in the UK market, and continued commercial scaling of the Teqcycle operation. The performance demonstrates management's strategic emphasis on addressing volatility through focus on higher-margin enterprise equipment channels.

Overall, the sequential quarterly deterioration from Q1's 5.3% decline to Q2's 8.6% contraction suggests that market conditions remained stubbornly tough throughout the spring period, tempering expectations for near-term revenue recovery despite the strong contract pipeline in CWS.

Profitability

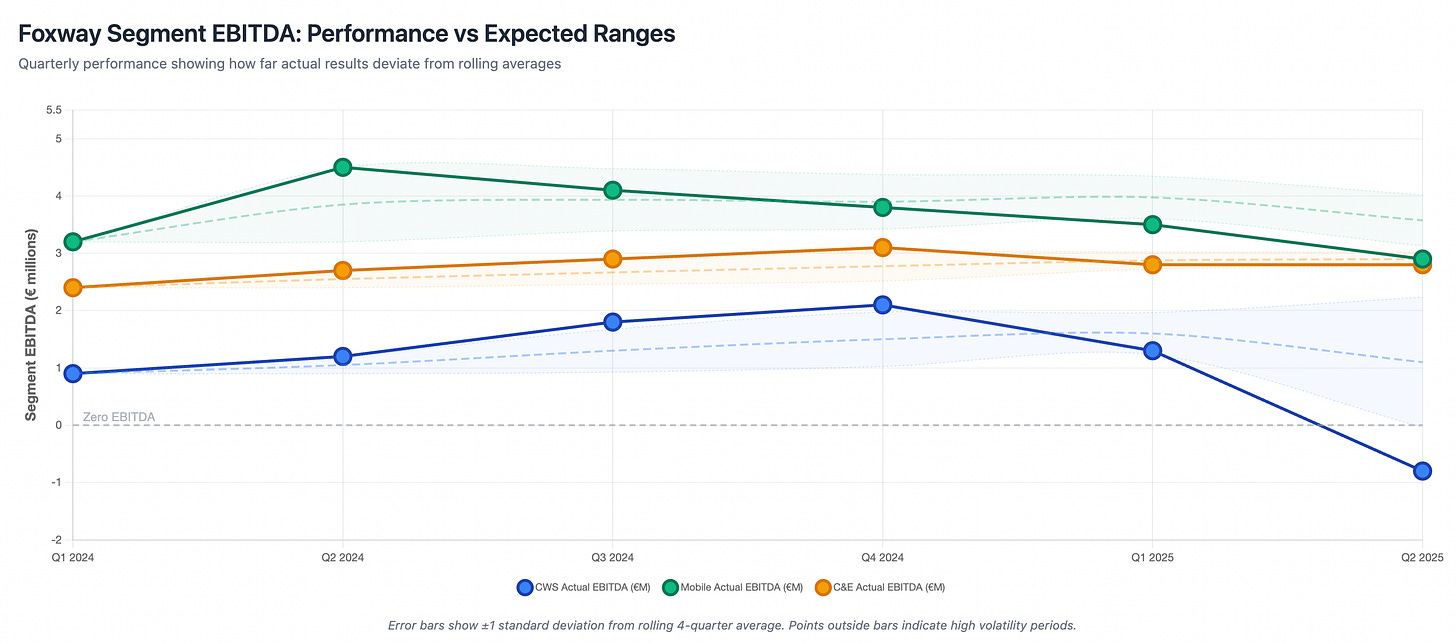

Foxway's Q2 profitability deteriorated markedly as fixed costs amplified the revenue decline's impact. Q2 Adjusted Operational EBITDA shrank 60.4% year-on-year to SEK 24.5 million (€2.1 million), with margins contracting to 1.3% from 2.9%. H1 2025 margins compressed to 1.6% from H1 2024's 2.4%, with absolute H1 EBITDA declining 38.3% to SEK 60.1 million (€5.2 million).

Q2 segment performance diverged sharply. CWS swung to an SEK 8.8 million (€0.8 million) loss from Q2 2024's SEK 14.5 million (€1.2 million) profit, with margins deteriorating from 2.1% to -1.4% due to unfavourable product mix and customer churn effects. Recommerce Mobile margins compressed from Q2 2024's 5.2% to 4.5% as EBITDA declined 24.3% to SEK 33.9 million (€2.9 million), reflecting competitive pricing pressures and the Apple sourcing challenges. Only Recommerce C&E delivered margin expansion to 5.6% from Q2 2024's 5.0%, generating SEK 32.6 million (€2.8 million) through enterprise equipment focus and Teqcycle scaling.

The gap between Q2 Adjusted EBITDA (6.4% margin) and Q2 Adjusted Operational EBITDA (1.3% margin) highlighted significant operational adjustments and transformation costs weighing on underlying performance. Currency effects reduced Q2 results by SEK 2.5 million (€0.2 million), but stripping this impact still revealed a 55% profit decline, suggesting some genuine operational pressure.

Q2 net financial costs increased to SEK 88.7 million (€7.6 million) from Q2 2024's SEK 83.2 million (€7.2 million), including SEK 92.0 million (€7.9 million) in net interest charges partially offset by SEK 6.3 million (€0.5 million) in positive exchange rate effects. Combined with the operational deterioration, this drove Q2 pre-tax losses to SEK 103.7 million (€8.9 million), emphasising the pressure on cash generation to cover the operational costs and high leverage.

Balance Sheet & Cashflow

As you’d expect, the revenue and earnings deterioration has put some pressure on the Balance Sheet. Net debt climbed 14.4% year-on-year to SEK 3,216.9m (€276.7m) whilst total equity contracted 8.6% to SEK 3,522.1m (€302.9m). The LBO structure's burden became more pronounced as alternative net debt (excluding IFRS 16 lease liabilities) rose 17.0% to SEK 2,240.3m (€192.7m), reflecting both operational underperformance and the high cost of capital. Though the equity-to-assets ratio improved to 47.7% from 42.2%, this primarily reflected asset base reductions rather than strengthened capitalisation, with bond loans remaining substantial at SEK 2,170.8m (€186.7m) and credit institution borrowings increasing to SEK 965.6m (€83.1m).

That put the focus on Q2 cash flow which reduced to negative SEK 99.3m (€-8.5m) from positive SEK 159.7m (€13.7m) a year earlier. Working capital demands intensified as inventory levels surged 30.7% sequentially to SEK 1,067.7m (€91.9m) following the seasonal stock build-up, particularly in Recommerce Mobile and C&E segments. The inventory increase, combined with reduced accounts payable to SEK 513.8m (€44.2m) from SEK 591.8m (€50.9m), created a negative SEK 122.8m (€-10.6m) working capital impact versus a positive SEK 121.2m (€10.4m) contribution in Q2 2024. For the half-year, operating cash flow reduced to negative SEK 247.8m (€-21.3m) with working capital absorbing SEK 301.2m (€25.9m), highlighting the structural cash generation challenges facing the business model.

Available liquidity tightened significantly as cash reserves halved to SEK 178.7m (€15.4m) from SEK 377.1m (€32.4m), whilst total available liquidity (including undrawn credit facilities) contracted 39.8% to SEK 506.4m (€43.6m). With untapped revolving credit facilities reduced to SEK 327.7m (€28.2m), the liquidity cushion narrowed considerably at a time when operational cash generation turned deeply negative and financial costs remained elevated at SEK 88.7m (€7.6m) quarterly. The combination of deteriorating operational performance, substantial debt servicing requirements, and compressed liquidity raises questions about debt load flexibility, particularly given the challenging market conditions affecting enterprise equipment sales and the competitive pressures evident across both CWS and Recommerce Mobile segments.

Summary

For balance, I have to point out that crunching numbers in isolation, especially on a quarterly basis, can overlook the strategic narrative in favour of the tactical challenges. Whilst revenue declined 8.6% to SEK 1,861.7 million (€160.2 million) and Adjusted Operational EBITDA margins compressed to just 1.3%, the SEK 165.8 million (€14.3 million) sequential increase in inventory to SEK 1,067.7 million (€91.9 million) is a deliberate investment. We’ve seen Alchemy5 and Lancaster Group Holdings6 do the same. This inventory build-up follows record lows at end-2024 and positions the company well for traditional H2 seasonal strength, including back-to-school demand, the Apple iPhone launch cycle, and the critical Black Friday and Christmas trading periods. Management's explicit framing of this as capacity building for H2 acceleration, combined with available liquidity of SEK 506.4 million (€43.6 million), suggests confidence in near-term demand, despite the current cash flow pressures.

Multiple operational catalysts align favourably for H2 2025 performance recovery, with CEO Patrick Höijer highlighting "new CWS contracts, improved Mobile sourcing, and continued Enterprise equipment and Teqcycle growth" as drivers for acceleration. I’d agree that the CWS division's momentum is compelling, but as is often the case, B2B new business strain can take it’s toll as revenue delay follows launch delay. The strengthened leadership team reinforces execution capability. Foxway's scale advantages, operating six tech centres across Europe with capacity expansion in Tartu adding 10,000m² by 2027, will provide meaningful operational leverage when volumes recover.

However, the debt incurrence test embedded within the bond facility presents a difficult structural constraint that may undermine Foxway's strategic flexibility. Having entered the second threshold period in July 2025, Foxway now faces a 4.50x leverage covenant, yet currently operates at an estimated 4.75x leverage based on Net Debt of SEK 3,216.9 million (€276.8 million) and LTM Adjusted EBITDA of SEK 677.4 million (€58.3 million). This calculation excludes Sale & Leaseback obligations of SEK 790.6 million (€68.1 million), which, if included, would push the economic leverage ratio to approximately 5.9x. This would trigger requirements for 40% equity contributions on any acquisitions, effectively neutralising non-organic growth in a consolidating market. The bond's step-down structure (5.50x initially, declining to 4.50x, then 3.50x by 2027) pointed to expectations of rapid EBITDA improvement and natural deleveraging that just hasn't materialised. There is an out. I think there's a 15% EBITDA synergy buffer that can be applied, but that's going to take some creative accounting in any M&A with this sector's current profit margins. And, the CFO has to put their name to it. It's possible Nordic Capital may look to restructure the debt into something that works better for the levels of working capital Foxway require to compete. This effectively transforms Foxway from potential sector consolidator into potential acquisition target, as better-capitalised competitors can pursue opportunities that remain structurally inaccessible to Foxway, despite their operational scale and market position. I am reminded of this quote from their CSO: "From our perspective, this means running businesses that can thrive in an economy not reliant on perpetual growth". Strap in.

Unless there’s big news, I’ll wait until the year-end results before another detailed update.

Peace,

sb.