Research Update: GiffGaff Revenue Analysis & Treasury Operations

Mutual giving and a fair bit of taking....

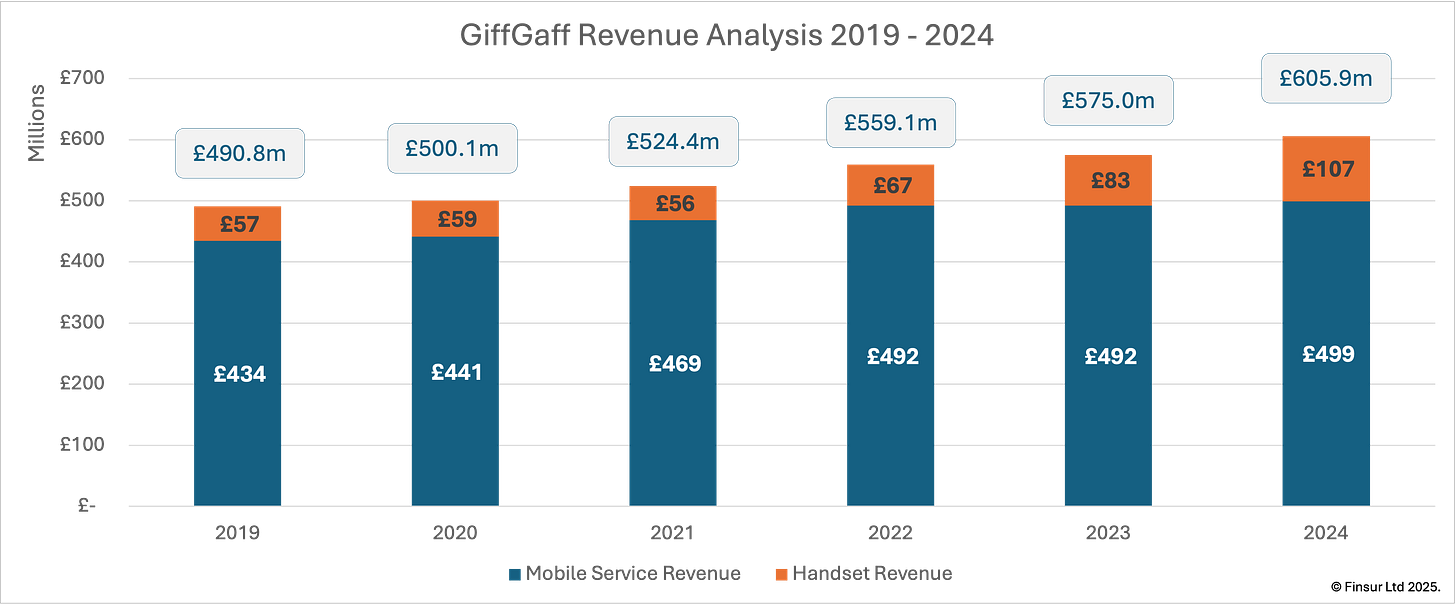

Key finding: GiffGaff reported £605.9m revenue in FY2024 (+5.4% YoY), with refurbished handset sales driving growth at 28.7% to reach £71.4m and an estimated 246,000 units.

If you can remember what you were doing in 2008 and were wondering what to do with any dormant entities you had lying around in your organisational hierarchy, you could have followed Telefonica’s lead and built a funky online MVNO with only a 3G SIM card product, no customer service and called it GiffGaff. Mad? Well not really, because it’s turned out to be a pretty good story and probably one of Telefonica’s better ideas.

I can’t recall if they were the first flanker brand, and to be entirely honest, I am not especially interested in their general financial and operational performance, despite them offering a great example of how to nail your marketing strategy. However, several years ago and not too far down their filed accounts, I became entirely fascinated by their refurbished device sales performance and what we might be able to imply. Therefore, the content of this update leans towards the handset implications rather than usual updates, although there’s a fascinating side-gig that’s definitely worth a mention.

Recap

O2 Communications Limited (04196996) was incorporated in April 2001 and then remained dormant until 2009. There was a hive of corporate secretarial activity including a short-lived name change to O2 Ash Limited in 2008 before the entity finally became GiffGaff a few months prior to launch on 25th November 2009. At the helm (until 2015) was Gav Thompson, head of O2 UK’s Brand Strategy, with eight principles and a “rather thin business plan”1. So, let’s see how that worked out…

Performance

FY2024 Key Metrics:

- Revenue: £605.9m (FY2023: £575.0m, +5.4%)

- Handset Revenue: £106.6m at 17.6% of total (FY2023: £82.8m, +28.7%)

- Refurbished Revenue: £71.4m, ~246k units (FY2023: £56.0m, ~190k units)

- Gross Profit: £125.4m at 20.7% margin

- Operating Profit: £30.8m at 5.1% margin (FY2023: £26.1m at 4.5%)

- Net Profit: £64.1m at 10.6% margin (FY2023: £57.6m at 10.0%)

- Financial Income: £32.9m from treasury operations

Source: GiffGaff Limited (04196996) filed accounts for year ending 31 December 2024

Just for context, GiffGaff had crossed the £500m mark back in FY2020 and the latest filing shows that overall revenue grew 5.4% from £575m in FY2023 to £605.9m in FY2024. The CAGR across the analysis period is 4.3% so the latest performance figures demonstrate stronger than usual growth. Looking at the revenue analysis in more detail shows that handset sales are really driving the improvement with an increase of £23.8m from £82.8m in FY2023 to £106.6m in FY2024. That’s a pretty decent 28.7% and in real terms over the analysis period handset revenue has almost doubled.

Continue reading for:

Complete Profitability Analysis & Operating Margins

GiffGaff’s Treasury Operations: The £500m+ Internal Banking Side-Gig

Detailed Refurbished Handset Performance & Unit Economics Analysis

Strategic Assessment: How Refurbished Devices Became Core Differentiation

Also available as a standalone pdf here.