Market Update: Preparing for the EU Circular Economy Act 2026

One Ring to Rule Them All?

It is my long-held and favourable belief that the four freedoms of the European Union are the most progressive and ambitious socio-economic and political construct since the Congress of Vienna gave it a go in 1815. However, the patience of even the most ardent Europhile must be tested by the sheer volume and complexity of regulatory output to which one must comply. Trying to figure out the current regulatory context in which the circular economy for consumer electronics operates is no small task and, just as we’ve got to grips with Ecodesign and Energy labelling regulation for smartphones and tablets, I’ll bet you can’t wait to get started on the EU Circular Economy Act due for adoption in 2026. With a well placed caveat that I’m not a compliance expert, I’ll try to bring everything together in one place, focus on the strategic considerations and hopefully provide a dynamic reference to make this as painless as possible.

The Current Maze/Map

All the current initiatives, directives and regulations sit within the broad umbrella of the European Green Deal which is the overarching policy framework and growth strategy for transforming the EU to climate neutrality by 2050. Essentially, it can be boiled down to the three enormously challenging targets:

No net emissions of greenhouse gases (GHG) by 2050

Economic growth decoupled from resource use

No person and no place left behind

The Green Deal effectively mandates that all EU policy areas contribute to climate, sustainability, and resource efficiency objectives and it’s immediately apparent how the circular economy for consumer electronics aligns neatly with the first two targets. The third target feels a bit Samwise Gamgee, although I’m sure there’s valuable intent beyond the soundbite because moving rapidly away from incumbent industry has proven to have disastrous long term effects1.

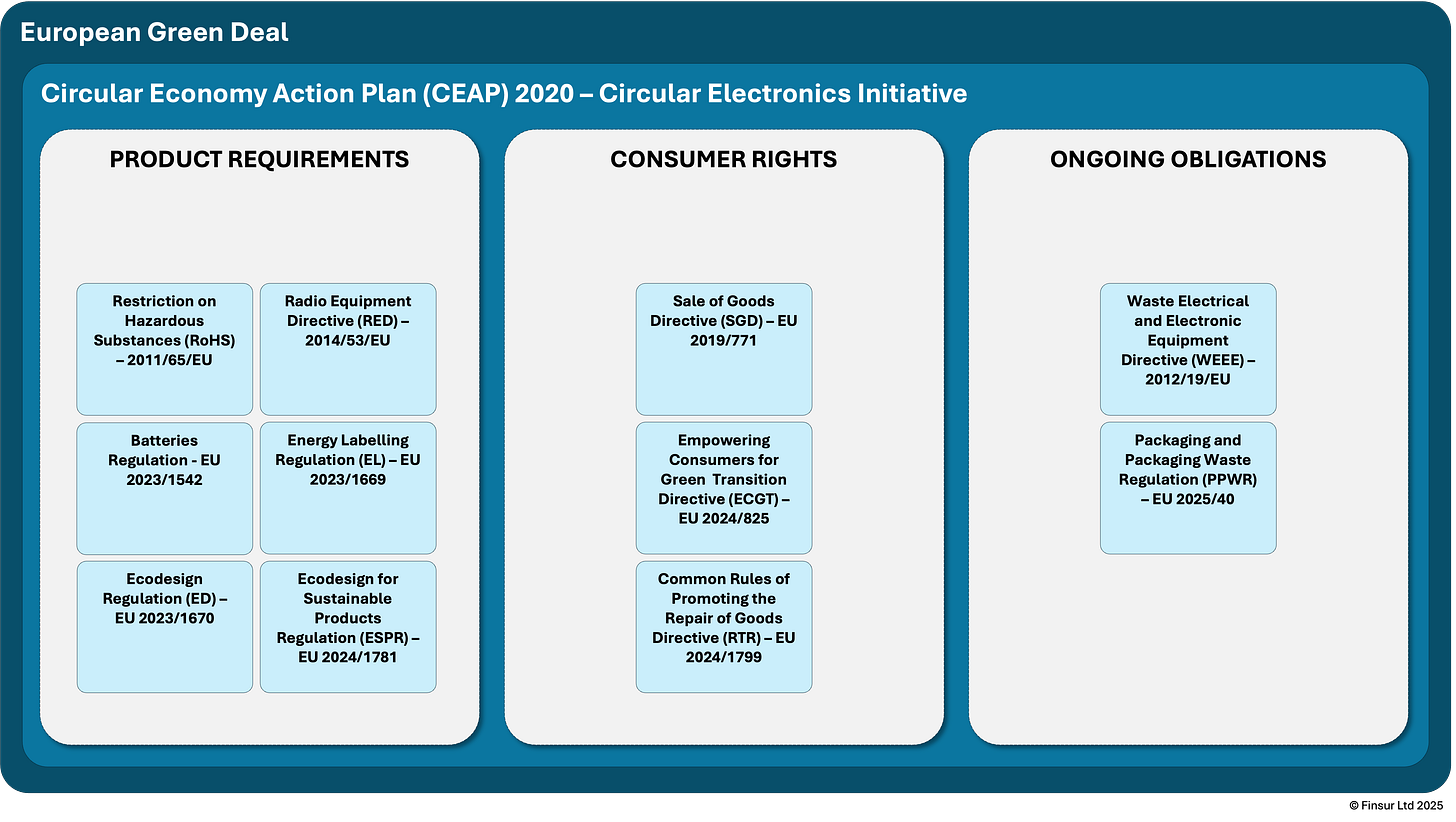

One of the main building blocks within the Green Deal is the Circular Economy Action Plan which was adopted in 2020 and sets out detailed, actionable targets and initiatives aimed at moving Europe from a linear to a circular economy. The plan covers product design, sustainable consumption, waste management, and resource use. The Circular Electronics Initiative was a sectoral response to promote longer product lifetimes and includes, among other things, the following actions:

Regulatory measures for electronics and ICT including mobile phones, tablets and laptops under the Ecodesign Directive;

Implementation of the ‘right to repair’, including a right to update obsolete software;

Regulatory measures on chargers for mobile phones and similar devices (including the introduction of a common charger);

Improvement of the collection and treatment of waste electrical and electronic equipment;

Review of EU rules on restrictions of hazardous substances in electrical and electronic equipment.

This is where the actual legislation (EU-wide) and directives (telling countries what to do, but not necessarily how) come into force. In the diagram above, I’ve grouped the directives and legislation into three categories: Product Requirements, Consumer Rights and Ongoing Obligations, just to help simplify things a bit.

Product Requirements

RoHS Directive - 2011/65/EU (as amended) - Adopted 8 June 2011: Restricts the use of ten hazardous substances (including lead, mercury, cadmium) in electrical and electronic equipment to protect human health and the environment. The directive covers all 11 waste electronic and electrical equipment (WEEE) categories including (3) IT and Telecommunications Equipment into which fall computers, laptops, tablets and mobile phones and (4) Consumer Equipment which includes televisions, audio equipment, video cameras, and other entertainment devices.

Radio Equipment Directive (RED) - 2014/53/EU - Adopted 16 April 2014: Harmonises laws for radio equipment across EU member states, setting essential requirements for health, safety, electromagnetic compatibility, and efficient use of radio spectrum.

Common Charger Directive - EU 2022/2380 - Adopted 23 November 2022: Amended the Radio Equipment Directive to mandate USB-C as the common charging port for mobile phones, tablets, and other portable electronic devices by December 2024. This raised much discontent within the secondary market at the beginning of the year, however, as I noted back then, the EU have been asking manufacturers to standardise chargers voluntarily since 2009 without success. This was, therefore, inevitable.

Ecodesign Regulation (ED) - EU 2023/1670 - Adopted 16 June 2023: Sets minimum efficiency and sustainability requirements for smartphones, mobile phones, cordless phones, and tablets, including durability, repairability, and spare parts availability for 7 years. This regulation serves as a transitional measure until potentially superseded by ESPR delegated acts post-2026.

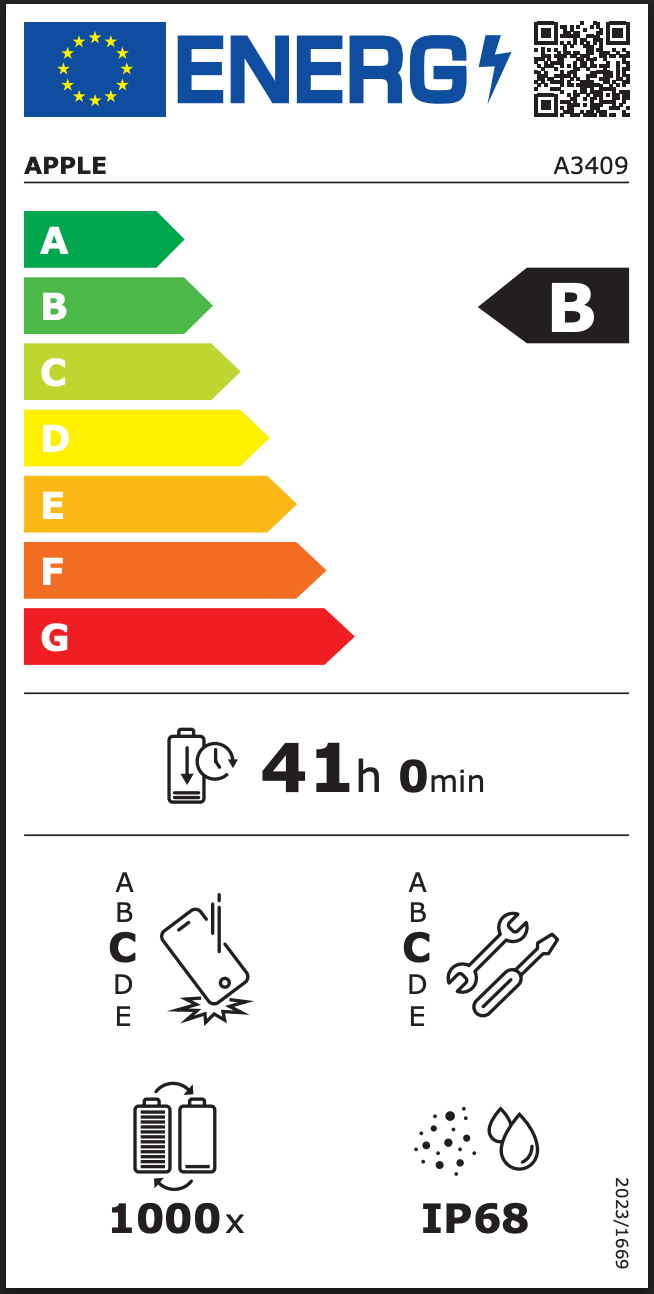

Energy Labelling Regulation (EL) - EU 2023/1669 - Adopted 16 June 2023: Requires mandatory energy labels for smartphones and tablets showing energy efficiency class, battery endurance, repairability index, and reliability ratings to help consumers make informed choices. You may remember Apple’s corporate passive aggressive response2 to completely valid criticisms of test ambiguities particularly around Full Resource Allocation which altered the labelling score by one whole grade. That, and when they asked three independent labs for a grade, they got a three-grade variance. Maddening.

Batteries Regulation - EU 2023/1542 - Adopted 12 July 2023: Lays down the requirements on sustainability, safety, labelling, marking and information to allow the placing on the market or putting into service of batteries within the EU. It also lays down minimum requirements for extended producer responsibility, the collection and treatment of waste batteries and for reporting.

Ecodesign for Sustainable Products Regulation (ESPR) - EU 2024/1781 - Adopted 13 June 2024: Framework regulation enabling the setting of sustainability requirements for virtually all physical products, introducing Digital Product Passports and rules to prevent destruction of unsold goods. ESPR will progressively introduce delegated acts that may replace existing product-specific Ecodesign regulations like ED 2023/1670 for smartphones (above).

Consumer Rights

Sale of Goods Directive (SGD) - EU 2019/771 - Adopted 20 May 2019: Establishes the fundamental consumer protection framework for all goods transactions, including consumer electronics with digital elements. It makes sellers liable for any lack of conformity that existed at the time of delivery and creates a comprehensive system of consumer remedies including repair, replacement, price reduction, or contract termination.

Empowering Consumers for Green Transition Directive (ECGT) - EU 2024/825 - Adopted 27 March 2024 - Transposed into national law by March 2026 - Full application September 2026: Amending the Unfair Commercial Practices Directive and the Consumer Rights Directive, the ECGT aims to ensure that consumers have better protection against unfair practices and access to better information. The directive specifically targets early obsolescence of goods, misleading environmental claims (‘greenwashing’), misleading information about the social characteristics of products or traders’ businesses, or non-transparent and non-credible sustainability labels. The directive mandates clearer information at the point of sale, including details about how long a product is expected to last and how easily it can be repaired. Regular readers will note from the June Monthly Round Up, that there seems to be a limit as to what some politicians are willing to accept in the fight against greenwashing as the Green Claims Directive came to an abrupt halt3.

Common Rules of Promoting the Repair of Goods Directive (RTR) - EU 2024/1799 - Adopted 30 July 2024: Commonly known as the right to repair directive and not necessarily the right to self-repair4. For smartphones, tablets, and other consumer electronics, it creates a new legal framework where consumers have a statutory right to request repair services even after their legal guarantee has expired. Manufacturers must provide repair services, ensure availability of spare parts, and offer clear information about repairability. The directive also establishes national repair information platforms and repair voucher schemes to make repair more accessible and affordable. It entered into force in July 2024, but member states have until July 2026 to implement it into national law. This creates an interesting dynamic where the regulatory framework exists but enforcement mechanisms are still being developed at the national level:

Repairers are obliged to provide standardised key information on their repair services via the European Repair Information Form.

The repair obligations are limited to products covered by the Ecodesign directive. Therefore, smartphones and slate tablets were covered by specific RTR obligations from June 2025.

Producers must inform consumers of the repair obligations and provide information on the repair services.

Producers may sub-contract repair to fulfil repair obligations.

There is an obligation for Member states to introduce at least one national platform to matchmake consumers with repairers. Repairers' registration on the platform is voluntary.

Consumers may choose between repair and replacement, unless the selected remedy would be impossible, or would impose costs on the seller that would be disproportionate.

Ongoing Obligations

Waste Electrical and Electronic Equipment Directive (WEEE) - 2012/19/EU - Adopted 4 July 2012: This directive creates comprehensive ongoing obligations for the entire lifecycle management of electrical and electronic equipment waste, establishing one of the most extensive producer responsibility schemes in EU environmental law. Manufacturers and importers must register with national authorities, participate in collection schemes that achieve minimum targets (currently 65% collection rate by weight), and ensure proper treatment and recycling of collected waste.

The directive covers a broad range of consumer electronics from smartphones to large household appliances, requiring separate collection systems, hazardous substance removal, and material recovery processes. Companies must maintain detailed reporting on the quantities of equipment placed on the market, waste collected, and materials recovered, while also contributing financially to national collection and treatment infrastructure.

The regulation also establishes strict treatment standards for recycling facilities and prohibits the export of WEEE to countries that cannot manage it appropriately, creating ongoing compliance monitoring requirements for all actors in the waste management chain.

WEEE Directive Review Update: In July 2025, the European Commission published an evaluation of the WEEE Directive that found while good progress has been made on environmentally sound handling of e-waste, the directive has not fully achieved its intended outcomes5. Nearly half of WEEE generated is still not being collected, and only three countries met the 65% collection target in 2022. The evaluation identified key gaps including inadequate coverage of new critical raw material-rich waste streams from renewable energy and digital technologies, and noted that only about 23% of recycling facilities implement high-quality treatment standards. The Commission will now consider the evaluation findings during the revision process for the WEEE Directive, as part of the planned Circular Economy Act for 2026. The revision is expected to expand the scope to include green and digital equipment and introduce mandatory treatment standards to improve material recovery rates.

Packaging and Packaging Waste Regulation (PPWR) - EU 2025/40 - Entered into force 11 February 2025: This regulation replaces the previous Packaging Directive with directly applicable rules across all EU member states, eliminating the inconsistencies that arose from different national implementations. For consumer electronics companies, this creates ongoing obligations around packaging design, material composition, and waste management that extend throughout the product distribution chain. The regulation sets binding targets for recycled content, establishes Extended Producer Responsibility schemes, and requires continuous monitoring of packaging waste streams. Companies must ensure their packaging meets recyclability class requirements (with only Class C or better allowed from 2030), comply with restrictions on harmful substances like PFAS, and participate in national collection and recycling systems.

The regulation also introduces specific requirements for e-commerce packaging, limiting void space ratios to 50% for electronic goods and prohibiting unnecessary packaging designed to artificially increase perceived product size. Most provisions become applicable from August 2026, giving companies 18 months to adapt their packaging strategies and supply chain operations.

One Ring to Rule Them All?

So is the solution to this regulatory maze the Circular Economy Act? A single harmonised framework which businesses can navigate and comply with, without a compliance department (throwing no shade), sounds seductive. However, the full legislative text is still pending, so there's no detail on the approach and whether rationalisation or simplification will materialise or, whether we'll just get different complexity. What we're likely to see is the latter. The European Commission press release on the 2nd July, announced a package of new rules on waste shipments, the WEEE review and new rules to improve recycling efficiency and material recovery from waste batteries. The announcement also mentioned a public consultation and a call for evidence from stakeholders.

Some of those stakeholders have already been contributing to the dialogue. DigitalEurope emphasise the need for regulatory streamlining to avoid "overlapping rules, high administrative burdens, and diverging national implementations"6 which they argue stifle innovation and competitiveness. Their focus centres on creating "harmonised EU-wide rules for a functioning Single Market" while calling for clear "end-of-waste" criteria and regulatory exemptions for manufacturers to support circular business models7.

Meanwhile, the European Environmental Bureau is pushing for more ambitious measures, advocating for binding resource consumption reduction targets and arguing that the EU should establish "science-based targets to keep material and consumption footprints within planetary boundaries"8. Zero Waste Europe strikes a middle ground, acknowledging that "secondary raw materials remain more expensive than primary"9 while calling for enhanced Carbon Border Adjustment Mechanisms and expanded recycled content targets. I’ve seen nothing yet from the European Consumer Electronics Retail Council.

The tension between industry calls for regulatory simplification and environmental demands for more stringent resource management suggests the new Act will indeed deliver different complexity rather than reduced complexity, a classic compromise that satisfies no one completely but advances the agenda incrementally. Less one ring to rule them all, more one ring to bind them.

Strategic Considerations While We Wait

The strategic challenge isn't just preparing for the additional compliance complexity, it's doing so whilst making enough margin in a market that leans toward price-based competition. However, there are some clues as to how the Circular Economy Act may turn out.

The repair, refurbishment, and recycling sectors have been actively shaping policy for years, with concrete results. The Right to Repair directive is law, smartphone repairability standards took effect in June 2025, and Digital Product Passports are coming via ESPR. These realities are likely to expand under new legislation and, with the remanufacturing sector's projected growth to €100 billion by 2030 and the creation of half a million new jobs10, the economic opportunity is too large to leave to chance.

Whilst this doesn't resolve the regulatory uncertainty, it does suggest a strategic direction: follow the repair sector's lead. They've successfully influenced policy before and continue to shape what comes next. Companies building circular capabilities incrementally, data infrastructure for device tracking, supplier relationships for repair operations, design processes that incorporate durability requirements, aren't betting on unknown futures. They're positioning for the expansion of measures that are already proving effective.

The emergence of solutions like Apkudo's Device Passport platform, launched this month11 to create persistent device records "from launch through trade-in, repair, and reuse," suggests some companies aren't waiting for complete regulatory clarity. Whether this represents strategic positioning or premature optimisation remains to be seen, but it indicates where sophisticated players think the infrastructure needs to go. Unfortunately, it now appears that Minthive left us all too soon12.

A patient capital advantage will remain crucial. Companies that can invest in circular capabilities without requiring immediate payback will be better positioned than those needing quarterly justification. But, the strategic advice becomes more concrete: build adaptive capacity around proven circular trends rather than waiting for regulatory clarity.

The 2025-2027 period becomes less about navigating complete uncertainty and more about positioning for the solidification and expansion of requirements that are already in place. Europe's regulatory leadership is creating another global standard, the question is whether businesses will embrace the emerging complexity as competitive advantage or resist it as compliance burden. And, from this ardent Europhile looking across the channel, I’d much rather take this progressive approach than the absolute vacuum that we’ve had here since Brexit.

Peace,

sb.

“We look forward to working alongside other stakeholders to address test method ambiguities in the future.” Apple Inc (2025) EU Energy Label for iPhone and iPad: An Explanation of Apple’s Methodology.

Ibid.

Great insights, there is a lot to digest. Appreciate you taking the time to outline the details.

I think smartphone OEMs that have foresight will realize that relying solely on new hardware and device sales will not last forever. Smartphones have become increasingly commoditized.

Most distributors of major smartphone brands earn low single digit margins and are heavily reliant on backend volume rebates to even earn that.

If the smartphone follows the path of PCs then the real money in the future will be in software and solutions.

Like you mentioned though, many companies are under so much short term (quarterly) sales pressure, you cant blame their leadership for not prioritizing circular goals.