Market Update: The price of device insurance data asymmetry

Please Find My Competitive Advantage...

Last weekend the Guardian published an article1 on phone theft, including data analysis from SquareTrade that showed 39% of all their thefts occurred in the UK and 42% of those thefts took place in London. That amounts to 16% of all thefts in Europe. All this despite SquareTrade’s UK customers making up only 10% of their European insured base. In any analysis there’s likely to be some bias. SquareTrade’s UK customer base is essentially mobile operator Three’s insurance programme2 and more of Three’s customers might be inclined to live in the larger towns and cities where thefts more often occur. But, regardless of any sampling bias, these are not great numbers.

According to a House of Commons Library research briefing published at the end of June3:

78,000 people had phones snatched in the year ending March 2024 (200 per day)

153% increase from previous year

London is the "epicentre" with £50 million worth of phones stolen in 2024

Met Police dealt with 64,244 mobile phone thefts (3/4 of all UK phone thefts)

With 48% of London phone thefts not being followed up, there’s been a recognisable fall in the public’s trust in the Met’s ability to tackle the problem4. That’s despite operations Calibre, Opal and Swipe and new legislation in the Crime and Policing Bill 2025. The problem has become bad enough to impact how we use our devices. In their annual research publication5, smartphone security start-up Nuke dive deeper into the concerns associated with phone theft and conclude that:

“We’ve reached a tipping point, where fears over the damage that can be caused by smartphone theft, are beginning to trump the convenience that these devices were meant to bring to our lives.”

And, despite the ability to apply various locks and the availability of built-in trackers (e.g. Find My), manufacturers and network operators have not been spared from criticism. In June this year, the Chair of the Science, Innovation and Technology Committee’s session on phone thefts, suggested that neither Apple or Google have an effective plan that does not involve IMEI’s, (i.e. addressing theft for parts) and were dragging their feet over global IMEI blocking. Things clearly got a bit tetchy with Apple’s representative responding they didn’t believe the police were doing their traditional policing job including sending Apple (I assume location) requests for stolen devices.

So outside of a trip to the Feiyang Times building in Shenzhen6 with a bunch of RMB in your fist and a doctorate in haggling, what to do? Well, at a personal level, besides phone wristlets7 or being ultra cautious about taking your phone out on a Westminster street8, from this substack’s perspective, the obvious mitigation is to ensure you’ve got adequate insurance coverage. And this is where things get interesting.

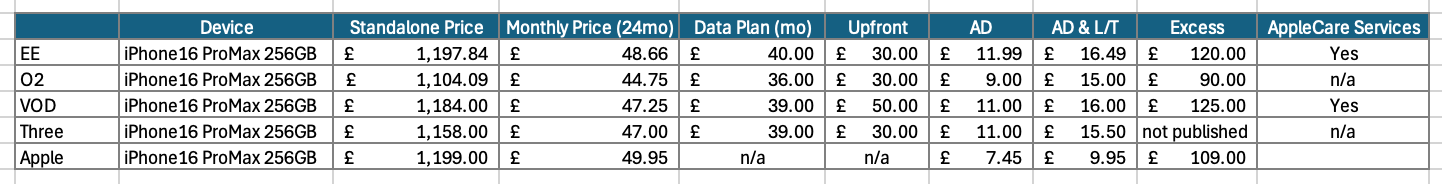

For the majority that get it, purchasing phone insurance naturally occurs when they buy their devices. Those buying insurance at some point afterwards make up the decent minority9. Either way, consumers are usually presented with the option to buy insurance covering Accidental Damage and Mechanical Breakdown or a more complete policy that additionally covers Loss and Theft with an associated uplift in premiums. If we just take the UK network operators, that uplift averages at 48% for EE, O2, Vodafone and Three. In and of itself, that’s not too interesting until you compare EE and Vodafone’s complete policy offering, which includes AppleCare Services (ACS), with Apple’s own insurance offering, AppleCare+ with Theft and Loss for iPhone.

Apple’s pricing is astonishingly low compared to the network operator averages either with or without ACS included. For an Accidental Damage and Mechanical Breakdown policy, AppleCare buyers are paying, on average, 44.3% less than an equivalent carrier policy. For the full cover product, the difference increases to an average of 58.3%.

There are a couple of possible explanations: first, the risk profile is different depending on the customer acquisition channel, i.e. Chubb (EE) and Assurant (Vodafone) observe different characteristics in Loss and Theft claims than AIG (Apple). But, given these carriers include ACS you might expect their prices to be closer to Apple’s pricing than O2 and Three, who don’t include ACS. Second, I fully expect the cost of claim to be somewhat in Apple’s favour and therefore to AIG’s advantage, but again, I can’t see this accounting for such a large pricing differential.

Lastly, you could expect some differences in the terms and conditions between AppleCare+ and the carrier’s ACS inclusive policy wordings. And it’s here that some concrete evidence can be found. The AppleCare+ with Theft and Loss policy wording includes the following exclusion:

“5.3. Theft and Loss Coverage. The Theft and Loss Coverage under this Policy does not cover You for:

5.3.1. any Theft or Loss of Covered Equipment where Find My is not enabled on the Covered Equipment throughout the Coverage Period including at the time of the Theft or Loss. Find My must remain enabled, and Your Covered Equipment must remain associated with Your Apple Account, throughout the Theft or Loss claims process;”

On the other hand, EE and Vodafone’s ACS inclusive policy wordings include no such clause, although Vodafone recommends activating your location finder app to help retrieve a lost device, unless it’s in an unfamiliar location!

I suspect the reason is all down to data. AppleCare+ policies are administered on behalf of AIG, by Apple directly which allows them to enforce Find My requirements because they have the technical capability to verify compliance. The administrators of Carrier-embedded ACS policies cannot practically enforce such requirements and must rely solely on police reports and honesty. Apple’s equivalent US insurance policy has the same exclusion whereas, T-Mobile’s Protect 360 product by Assurant does not. I suspect, though I haven’t checked everywhere, this is Apple’s global standard where theft and loss are available coverages.

No such exclusion exists in the Preferred Care with Loss and Theft from Asurion for the Google Pixel, nor do they exist in the Samsung Care+ policy wordings. Whether this is down to the required data not being available or verifiable, or whether this is down to the fact that Google and Samsung do not process claims on behalf of the insurer, I can only guess. It’s always possible that it’s a product design oversight or they simply don’t want to have that conversation with an irate customer who didn’t read the complete terms and conditions.

Is this enough to bridge the pricing gap? Possibly. However, this data asymmetry raises broader questions about fairness and market access. Under GDPR, consumers have rights to data portability, yet Apple's insurance advantage relies on exclusive access to the behaviour and security data that consumers generate. Should Apple be required to make Find My status and device security data available to other insurers, either directly or through consumer-controlled APIs? The current arrangement offers far superior pricing to AppleCare+ customers, but it also exploits a closed ecosystem that disadvantages consumers who prefer alternative insurers and competitors who cannot match Apple's verification advantage. As policymakers grapple with Big Tech regulation, the insurance sector may again become a battleground for data access rights.

Peace,

sb.

P.S. Thank you to the subscriber who suggested this might be worth some research. You know who you are. To the rest of my subscribers, please feel free to suggest any article topics. I’ve got a long ToDo list, but I’m always happy to explore your suggestions, especially if there’s available data.

I think apples own program also has the visibility to check if the device has been locked which a standard police report would not.

Interesting point about Apples "find my" and apple id requirement vs standard insurers which only require a police report.

Curious what exactly it is about that extra data visibility though that gives apple the ability to price their insurance lower? Maybe it lowers the potential for fraudulent claims? Eg if apple sees the device is in shenzhen they are appropriately satisfied it is stolen vs in london?