Research Update: Asurion Europe Limited FY2024

Every little helps...

Key Findings: Asurion Europe Limited reported £16.04m revenue in FY2024, down marginally from £16.56m, with the Tesco Mobile insurance programme contributing the bulk of UK revenues. Operating profit improved 56% to £2.18m despite gross profit declining 15%. The critical strategic issue: Tesco Mobile contract expires August 2026, putting a £50m premium programme into competitive tender against SquareTrade, Likewize and Assurant.

Asurion Europe Limited (06568029) and Asurion Soluto Europe Limited (10163748) filed FY2024 accounts (year ending 31/12/2024) at the end of September and give us an opportunity to check back in on progress.

Thanks to their rather large insurance programmes with Verizon and AT&T in the US, a substantial presence in Japan and a few other programmes dotted around the world, Asurion probably have the right to call themselves the biggest tech care company in the world1. Unfortunately, despite years of grind and a blistering -£169m in the profit and loss account on the balance sheet, that claim has never been valid in Europe.

Recap

Asurion operate three entities in Europe: Asurion Europe Limited, the main operating company; Asurion Soluto Europe Limited, the tech support entity, which is essentially dormant2 and; WDP Insurance based in Gibraltar. They managed the H3G insurance programme in the UK up until 2020 and have managed the Tesco Mobile insurance programme since around the same time. There’s an eyewear insurance available from Sunglass Hut (Luxottica) and late last year they announced the Preferred Care and Preferred Care+ products with Google, covering phones, watches and tablets.

Performance

FY2024 Key Metrics:

Revenue: £16.04m (FY2023: £16.56m, -3.1%)

UK Revenue: £3.48m (21.7% of total)

Operating Profit: £2.18m (FY2023: £1.40m, +56%)

Employees: 59 (FY2023: 52)

WDP Insurance GWP: £51.84m (FY2023: £51.59m)

WDP Net Loss Ratio: 24%

Tesco Mobile Attachment Rate: ~11.3% (est. 413k policies)

Tesco Contract Expiry: August 2026

Source: Asurion Europe Limited (06568029) and WDP Insurance filed accounts for year ending 31 December 2024

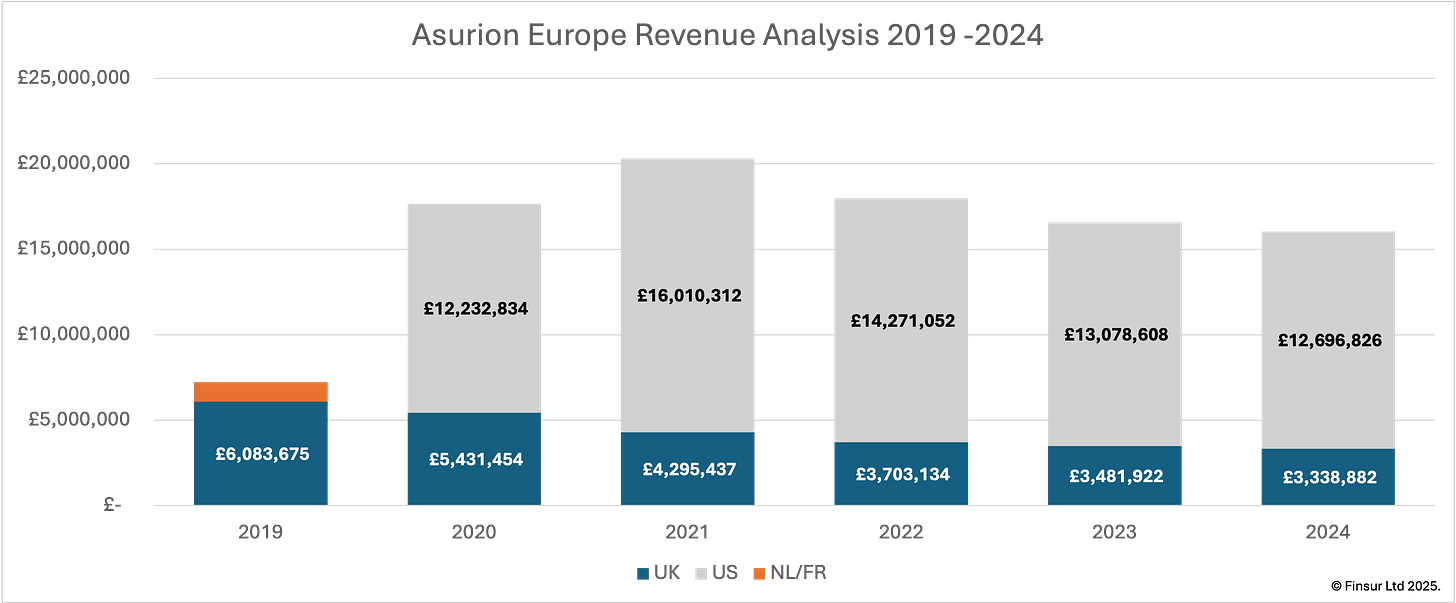

Total turnover declined marginally from £16.56m in FY2023 to £16.04m. The drop came from both elements of the revenue stream. The larger portion of the revenue comes from the US parent in the form of licence income for a market support agreement. It looks like the treasury function have settled on an average US contribution close 80%. For FY2024, UK revenues dropped to £3.48m (21.7%) and US licence revenues dropped accordingly to £12.56m (78.3%).

Looking at the last filed WDP Insurance accounts, under the contract with H3G run off premiums could have been written up until March 2025. However, I assume they would be very low by now. It’s also likely to take a while for the Google Preferred Care insurance programme to ramp up from the October 2024 launch and I can’t imagine the SunLove insurance programme for Sunglass Hut contributes any meaningful premium yet either. Therefore, I expect the bulk of the FY2024 revenues to have come from administering the Tesco Mobile insurance programme. This is reflected in the chart above with the YoY decline in the UK revenue since 2019 stabilising over the last two years.

For a fuller picture, we must consider the insurance company revenue as well. Gross Written Premiums at WDP increased ever so slightly to £51.84m in FY2024 from £51.59m the previous year. Net Written Premiums (after reinsurance) fell slightly to £2.56m from £2.58m. The vast majority of reinsurance (95%) is placed with a related party through a quota share arrangement with the remaining 5% presumably being placed with the client’s captive insurance company on a 100% fronting arrangement.

Continue reading for:

Profitability analysis including WDP Insurance technical account performance

Balance sheet dynamics and £28m unrecognised deferred tax assets

Tesco Mobile Protect programme economics: attachment rates, claims mix, commission structure

Strategic assessment of August 2026 contract renewal and competitive positioning

Also available as a standalone pdf report here.