Research Update: Currys Retail Limited FY2025

To liquidity and beyond, techspectations...

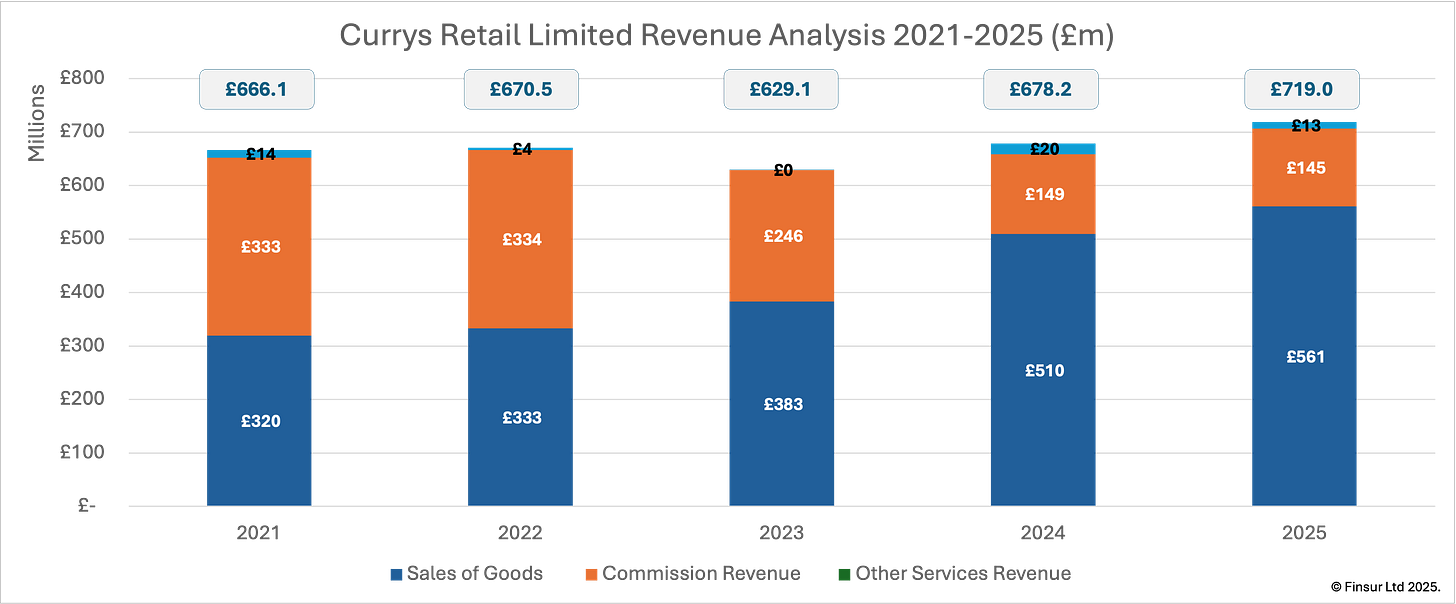

Key finding: Currys Retail Limited reported £719.0m revenue in FY2025 (+6.0% YoY), with the transformation from commission intermediary to device retailer now structurally complete—sale of goods now represents 78% of revenue versus 48% in FY2021.

In last week’s scenario planning article on based on the CCS Insight prediction that by 2027, over a third of mobile phone sales in the UK would be directly from the manufacturer, there were necessarily some losers. Whilst the carriers currently have the biggest sea from which to fish, other multi-channel retailers, based on the scale of the possible transition would not be able to escape the dragnet. Timely then, was the FY2025 filing from Currys Retail Limited (02142673) which gives us a view up until May 2025.

If you’re looking for wider analysis of Currys Group PLC performance, the July FT article is an excellent, if brief, summary of the current perils in UK retailing1. Despite the skittish shareholders and fending off a takeover approach last year, £8.7bn in revenues across the group with £162m adjusted profit before tax generating £149m in free cash flow is a serious business. Alex Baldock’s Shop Direct days have provided the blueprint for successful consumer credit provision with almost 22% of group-wide eligible spending done through credit and, the active Care & Repair plans count has held pretty steady despite a 2% drop this year at 9.9m across the group with 1.6m repair events in the year. Anyway back to Notchwave…

Recap

If you remember the name Notchwave Limited, I hope you’re sitting on a beach sipping a Piña Colada for breakfast, happily delirious in a splendidly notorious retirement. The company was originally registered in 1987 but it wasn’t until the 2nd March 1989 that one Charles William Dunstone and one Julian Mark Brownlie joined the director slate, changed the name to Professional Cellular Services Limited, put in six large and set their sights on taking mobile to the high street. I love that the principal activity in the 1989 accounts was the “installation of and trading in cellular telephones”. Turnover in their very first accounting period was £8,710.

Just two years later the name was changed again, this time to the far more familiar The Carphone Warehouse Limited. And thus it stayed, seemingly forever, on high streets all over the continent. Times were exciting. There was the Geek Squad and Best Buy joint ventures across Europe and the US, the TalkTalk spin off, a knighthood in the Queens Honours of 2012, a captive insurer in Ireland, joint ventures with Virgin in France, ICO fines, X-factor sponsorships, the iD Mobile spin up and a merger with Dixons in 2014/15 which ultimately saw the closure of all 531 stand alone Carphone Warehouse stores in the UK2. Times changed, we changed, the name changed again to Currys Retail Limited (“CRL”) in October 2021 and here we are, a “bloody good run” indeed3.

Performance

FY2025 Key Metrics:

Revenue: £719.0m (FY2024: £678.2m, +6.0%)

Gross Profit: £67.8m at 9.4% margin (FY2024: £68.2m at 10.1%)

Operating Profit: £42.2m at 5.9% margin (FY2024: £37.5m at 5.5%)

Net Profit: £67.3m (FY2024: £50.9m)

Net Assets: £526.2m (up 15% YoY)

iD Mobile Subscribers: 2.2m (FY2023: 1.3m)

Estimated Units Sold: ~1.5m at ~11% market share

Source: Currys Retail Limited (02142673) filed accounts for year ending May 2025

Total FY2025 revenue increased 6.0% or £40.8m to £719.0m, from £678.2m in FY2024. Over the five-year analysis period that’s an 1.9% compound annual growth rate from a £666.1m baseline in FY2021. This year subsidiary’s growth featured in the PLC report, with management highlighting handset-only sales and iD Mobile as the strongest performing categories. Behind the headline growth, however, the revenue mix has been shifting significantly, driven in part by the long-term decline of network commission revenue following the termination of EE and O2 contracts.

In FY2021, sale of goods (handsets and accessories) accounted for 48% of revenue, with network and insurance commissions representing just shy of 50%. Other services made up the small remainder. By FY2025, if the commission stabilisation is anything to go by, the transformation appears to be complete: sale of goods now constitutes 78% of the business, whilst commissions have contracted to just over 20%. The strategic repositioning toward iD Mobile (the company’s MVNO operating on Three’s network) and Vodafone-only distribution has fundamentally altered the revenue composition.

Sale of goods has grown every year since FY2021, with the latest increase of £51.5m (10.1%) taking FY2025 revenue to £561.2m. This represents a five-year CAGR of 15.1%, significantly outpacing total revenue growth. The device sales expansion has been supported by iD Mobile’s subscriber base growing from 1.3m (FY2023) to 2.2m (FY2025), alongside increased handset-only sales to customers not taking network contracts.

Commission Revenue, by contrast, declined at a -5.7% CAGR over the period, falling from £332.6m (FY2021) to £145.0m (FY2025). However, the pace of decline appears to be moderating. FY2025 saw commissions fall just 2.7% versus the significant declines in prior years: -39.4% in FY2024 and -26.3% in FY2023. The stabilisation suggests the structural transition may be approaching completion. Other Services revenue, comprising delivery, installation, product repairs and support, has exhibited significant volatility over the analysis period, declining from £19.6m in FY2024 to £12.8m in FY2025.

The revenue dynamics indicate that Currys have made material market share gains in handset sales over the last year. Synthesising price band information from the October 2025 (n=1,001)4 survey implies that, using a weighted ex-VAT ASP of £367, Currys are shifting approximately 1.5m units. If I momentarily assumed that all sales were phones it would mean a market share of approximately 11%, positioning Currys as the dominant player in the multi-channel retail segment with approximately 57% of sales.

Continue reading for:

Complete Profitability Analysis

Balance Sheet & Cashflow Assessment

Strategic Analysis including circular economy positioning

Also available as a standalone pdf here.