Research Update: Rebuy Recommerce GmbH

Rebuy's rebound...

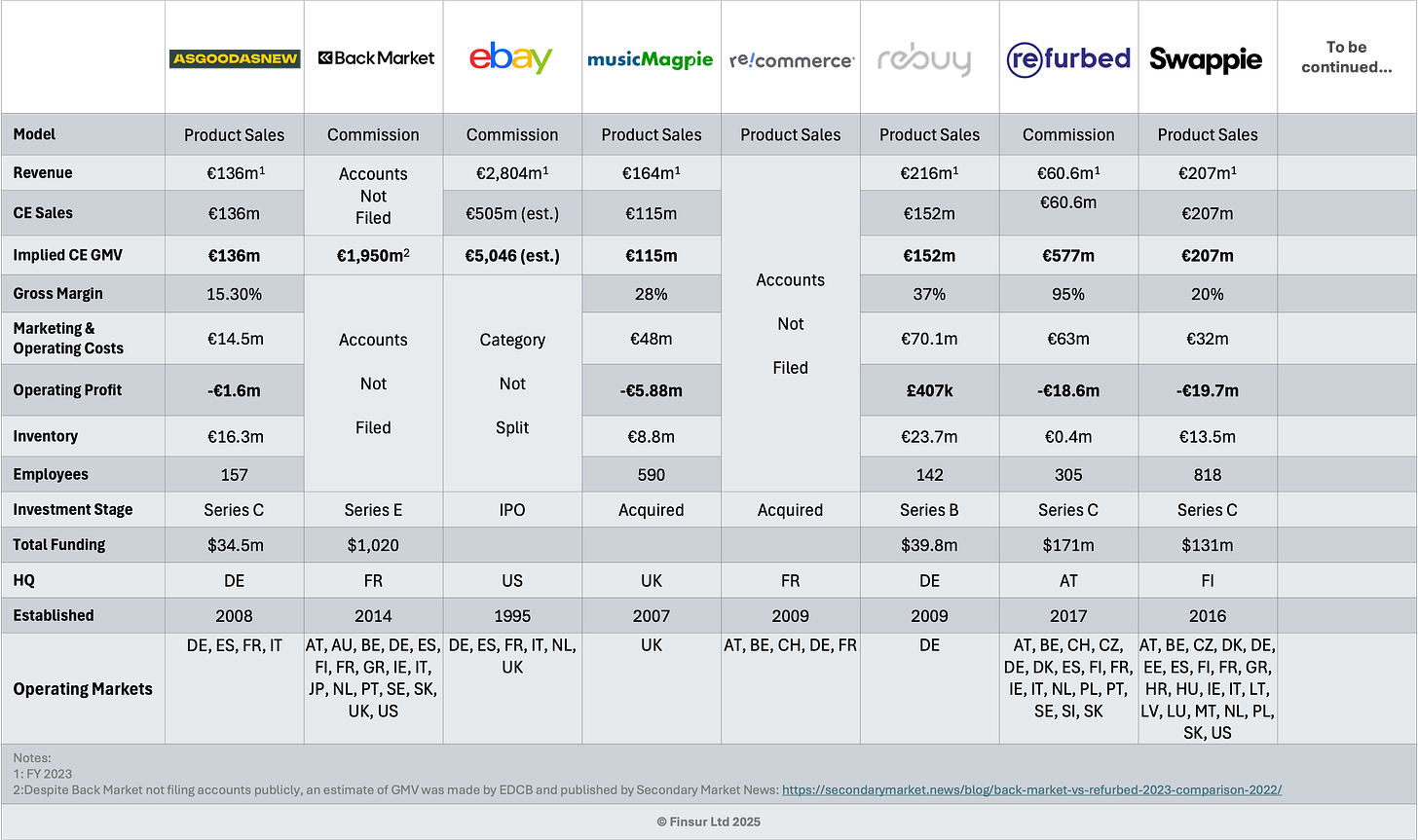

In February this year, I offered some thoughts on the major European marketplaces that buy, sell or broker consumer electronics, mostly smartphones1. Back then I was using Rebuy’s FY2022 data. Just after I’d published the article, their FY2023 filing was lodged and I’ve only just got around to taking another look, partly prompted by the news their 2024 results had exceeded €220m2. Whilst this year’s headline number offers some directional information, taking a deeper look at Rebuy’s FY2023 filing should give us a bit more information about organisational performance and the current sector dynamics.

Recap

Rebuy are based in Berlin with subsidiaries in Poland and the UK as well as several entities in their home territory. They began life as “Trade-a-Game” and expanded into consumer electronics in 2009. Total equity funding to date stands at $39.8m with European PE firm Evoco owning 54.1% of shares. Unlike true marketplaces (e.g. Backmarket and Refurbed), Rebuy purchase devices, repair and refurbish where necessary and then sell on. Sales are split between consumer electronics (mainly smartphones) at approximately 70% of revenue and media (books, movies, video games & music), the remaining 30%. According to tracxn, Rebuy have approximately 24% of the German market, although I’m not keen on web traffic as the indicative methodology.

In the February article, I suggested that by taking Rebuy’s FY2022 numbers in isolation, the result was not great. However, that would be a disservice given the unusually quick write down on the TRG acquisition and a spike in variable costs, particularly logistics. It was also clear that management had been investing for growth and were well positioned to capitalise on operating efficiency gains.

Performance

So, it was great to see that growth came along in the form of a 6.8% revenue improvement, increasing from €202m to €216m. It sounds like that may have stalled in FY2024, which might not be surprising given economic and competitive sector dynamics. Perhaps the more notable story is the gross margin improvement which had been in decline for the last three years up to the FY2022 result. In FY2023 gross margin improved from 36.44% to 37.5%, up 1.1% in recessionary environment with a drop in consumer spending. As we know, the sector has been under significant margin pressure and the shift towards lower margin consumer electronics from media was taking its toll. Management have put the gross margin improvement down to a consistent focus on profitable growth which is possibly code for better sourcing and pricing discipline, focusing on higher margin opportunities and operational leverage from their efficiency initiatives.

Profitability

The gross margin recovery provided some assistance to the operational turnaround. Rebuy achieved an operating profit (EBIT) of €407K which, whilst still small, is a notable swing from the €4.318m operating loss recorded in FY2022. EBITDA followed from €634K to €2.846m, demonstrating that the business model can generate meaningful cash at the operational level.

This is particularly noteworthy in the context of sector peers who continue to struggle with profitability despite years of operation. Whilst Swappie posted a €21.6m loss and Refurbed implemented 20% workforce reductions following unsustainable losses, Rebuy increased headcount from 128 to 142 employees whilst still achieving profitability.

Management are beginning to prove that the integrated recommerce model, buying, refurbishing and selling directly rather than operating as a pure marketplace, can achieve sustainable economics when operational excellence is prioritised over aggressive expansion.

The path to profitability wasn't achieved through cost cutting alone, but through disciplined spending growth. Personnel expenses increased from €10.4m to €12.4m, reflecting targeted investments in operational capabilities. However, other operating expenses rose only 3.3% to €70.1m despite revenue growth of 6.8%, indicating genuine operational leverage that pulled the business from loss-making to profitable.

This represents a dramatic contrast to 2022 when operating expenses surged 14.8% driven by aggressive marketing spend and higher logistics costs. In 2023, management clearly exercised marketing discipline with logistics costs remaining the primary driver of expense growth, but that’s necessary consequence of operational expansion rather than speculative investment on the socials.

Cash Flow and Balance Sheet

The operational improvements translated directly into cash generation, with operating cash flow turning positive at €603K compared to -€300K in 2022. This represents a positive shift in the business model from cash consumption to cash generation and should begin to provide a sustainable foundation for future growth.

As is usually the case, working capital management required substantial additional investment, with inventory levels increasing by €4.6m to €23.7m, a 23.5% rise. Management justified this as necessary to support higher product availability and growth targets, but it still represents a major cash commitment. The inventory build, combined with the modest operating profit, meant that despite positive operational performance, the company required increased utilisation of credit facilities to fund growth. The €4.6m working capital investment effectively absorbed most of the operational cash generation, highlighting the capital-intensive nature of the business model even when executed efficiently.

The materials cost ratio improved from 63.6% to 62.5% suggesting more efficient sourcing discipline, whilst other operating expenses increased 3.3% to €70.1m, including higher logistics costs from expanded operations.

Rebuy significantly strengthened its financial position during 2023, securing additional credit facilities increasing the main credit line from €15m to €30m, with an additional €5m facility added in December. Total available credit lines reached €35m, of which €15.9m was utilised at year-end, leaving €19m unused capacity for operational flexibility. The balance sheet showed total assets growing to €38.8m, though equity declined slightly to €5.2m due to the net loss.

The company maintained bank debt of €17.6m, primarily for working capital financing, with all facilities due within the year. Cash and bank balances of €2.8m, combined with the non-utilised credit facilities, positioned the company well for continued operations and growth, though for a company with limited equity (€5.2m), this level of working capital requirement underscores both the operational challenges and the financial constraints that continue to characterise the sector.

Summary

Rebuy's achievement of operating profitability while maintaining growth is a positive and welcome indicator for observers and investors who, despite some of the early valuation hype, may have become increasingly sceptical of the sector’s potential. However, Rebuy benefits from the structural advantage of the 30% media revenue providing higher margins than dedicated device refurbishers, which might not be replicable across the sector.

After all, that same business model and revenue mix didn’t work out so well for Music Magpie. But there are differences. As a measure of productivity, in 2023, Music Magpie were running off £231,000 revenue per employee versus Rebuy’s €1,524,000; Music Magpie’s gross margin at 27.7% was 10% behind Rebuy’s core business economics and; Rebuy have now demonstrated operational leverage by growing revenue faster than costs, while Music Magpie suffered from declining revenue with sticky cost base.

The real test, however, will be whether Rebuy have sustained this performance through 2024 and then beyond, particularly given early indications that revenue momentum may be moderating. Nevertheless, the operational foundation they've built in 2023 provides a strong platform for navigating what is a challenging market. It also validates that management's earlier investments in operational efficiency and "profitable growth" strategy were well-directed, even if the path included some costly lessons along the way.

For completeness, here’s the comparison chart from the February article with Rebuy’s updates:

Peace,

sb.

What are services that rebuy sells in their media revenue? Revenue diversification from unforgiving and tough business of device trading seems a winning formula.