Research Update: WeBuyAnyPhone FY2024

Will Be Acquired, Possibly...

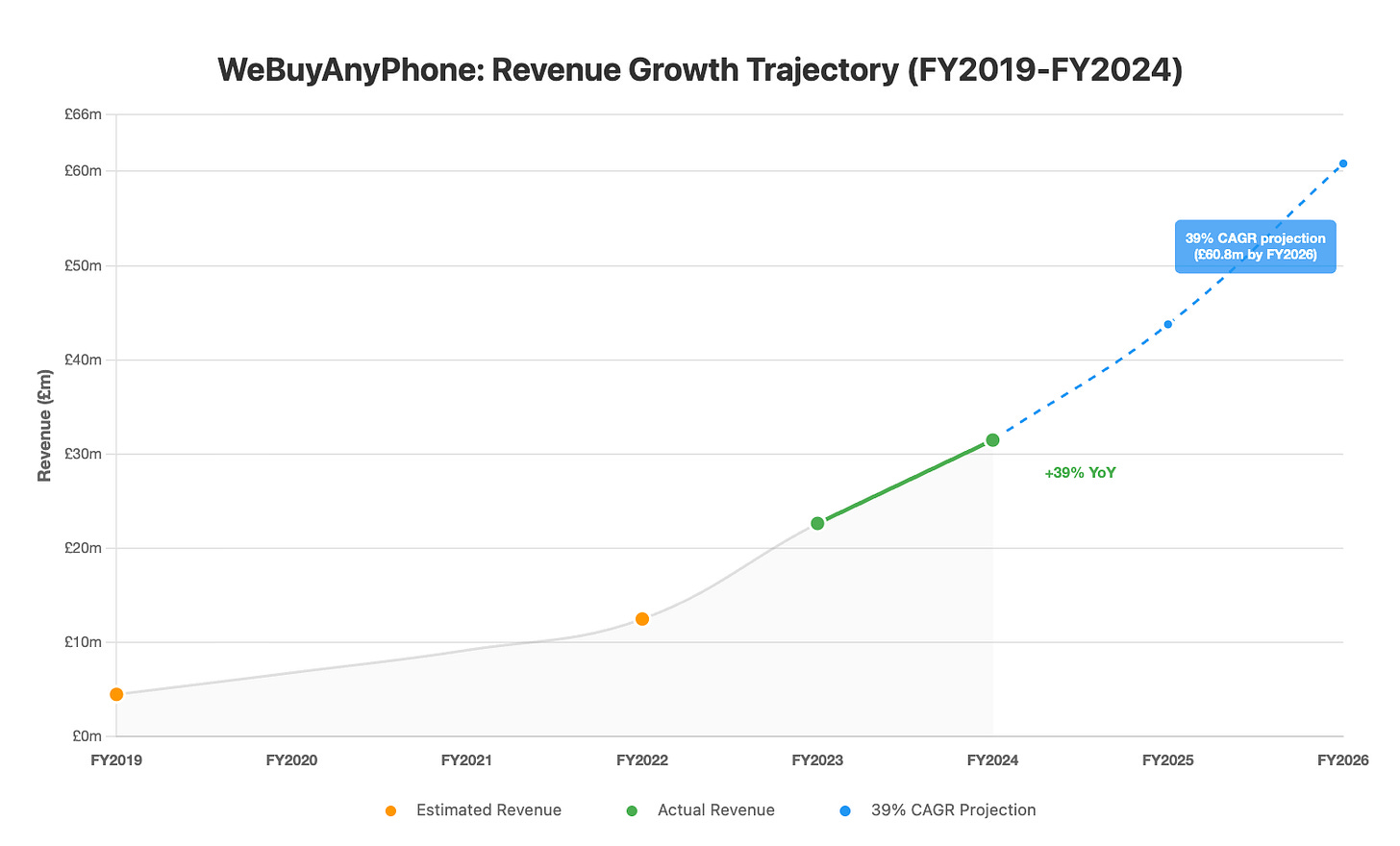

Key Finding: WeBuyAnyPhone reported £31.48m revenue in FY2024 (+39.1% YoY), with gross margin improving 110 basis points to 25.2%—the self-funding business model achieved 76% cash conversion whilst almost entirely eliminating accumulated balance sheet losses.

When researching markets and companies for an article, I sometimes procrastinate until I’m clear about my theme or angle. A genuine take on strategy or performance matters (to me); writing something that’s worth writing. For this particular article, there was no such dilemma. As soon as the notification came through and I opened the filing, I was struck by the single year growth. No procrastination required.

Recap

Publicly available details are a little thin on the ground, but WeBuyAnyPhone (08321525) began life as E-GIANT Ltd incorporated at the end of 2012 by Alex Berthonneau. Soon after James Ashby became a director and things ticked along with a small loss in the first year but breaking even a year later. Around 2014/2015 serial entrepreneurs Darren Ridge and Aaron Brown became shareholders with the entity continuing to file small company accounts and posting some ups and downs in the Profit & Loss account.

After a few years of increasing losses, Ridge and Brown took positions as E-GIANT entity directors in 2018 and despite a profitability blip in 2019, losses continued to build on the balance sheet until 2022. That may have been the year of new beginnings with Berthonneau ceasing to be a director (Ashby had left in 2017), a name change to WeBuyAnyPhone (WBAP) and a business entity that was almost at break even.

Since then, the balance sheet loss has been almost wiped out and for the first time in FY2024, the entity has filed full accounts, although I’m not sure it needed too. That said, it’s always good to have access to full data, especially if it’s voluntary, so let’s have a butcher’s1.

Performance

FY2024 Key Metrics:

- Revenue: £31.48m (FY2023: £22.64m, +39.1%)

- Gross Profit: £7.94m at 25.2% margin (FY2023: £5.47m at 24.1%)

- Operating Profit: £1.76m at 5.6% margin (FY2023: £1.26m at 5.6%)

- Net Profit: £1.67m at 5.3% margin (FY2023: £1.19m)

- Inventory: £622k (9.6 stock days / 38x turns)

- Employees: 43 (FY2023: 33)

- Estimated Unit Throughput: ~100,000 devices

Source: WeBuyAnyPhone Limited (08321525) filed accounts for year ending 31 December 2024

Remember, that like many other companies in the device lifecycle space, WBAP operate on both sides of the consumer coin. WBAP itself buys a phone from you and PhonesDirect (a WBAP trading name) will sell you a new or refurbished device. Full accounts filed for FY2024 means actual revenue numbers are available for the past two financial years only, beyond that I am making (probably significant) assumptions.

FY2024 saw a remarkable 39.1% top-line growth from £22.64m in FY2023 to £31.48m. That’s £8.85m in new sales and a significant operational scale up with all revenues from the UK market only. This is complete supposition, given filing thresholds meant that WBAP needed to file only limited accounts, but gross profit levels in FY2022 imply an annualised turnover of approximately £12-13m and going further back, by looking at the debtor days analysis in FY2019 suggests an annualised turnover in the region of £4-5m. That’s a substantial growth trajectory over the 5 year period. The dotted blue line in the chart below shows what maintaining 39% CAGR would mean, reaching £60.8m by FY2026, raising the critical question: can this pace continue given sector-wide device supply constraints?

PhonesDirect sells a range of refurbished devices from a good condition iPhone 11 at £140 to an iPhone 14 Pro Max starting at £405, with mid-range models priced around £225-£260. The latest average selling prices (ASP) from my device survey a few weeks ago suggests used selling prices are around £290 - £330 for Apple-focused refurbishers. At these prices the FY2024 turnover implies throughput in the order of 100,000 units annually with FY2023 at around 75,000. I’m using October 20252 ASP data against FY2024 revenues, so consider this a directional estimate rather than precise unit counts.

Continue reading for:

Complete Profitability Analysis including detailed unit economics

Balance Sheet & Cashflow Assessment

Strategic Analysis and sector consolidation outlook