AO World PLC Research Update

They're generatin' steam heat...

AO World PLC posted their FY2025 results on the 18th June including revenue growth, record profits and the global number one position rated at scale on TrustPilot1, no less. For those of you that aren’t familiar with the “UK’s most trusted electrical retailer”, they are one of the largest major domestic appliance (MDA), small domestic appliance (SDA) and consumer electronics retailers in the UK with TV ads soundtracked by the annoyingly suitable Ramones classic, Blitzkreig Bop.

AO acquired Mobile Phones Direct Limited at the end of 2018, MusicMagpie in October 2024 and, they’ve built a decent size insurance programme. Therefore, I’ll leave the buy, hold, sell recommendations to the raft of analysts that provide coverage2 and stick to the bits that interest us: mobile, trade-in and insurance. Up first though a bit of context…let’s go

Recap

John Roberts, the straight-talking founder and CEO began selling appliances online over a £1 bet in 2009 and has subsequently built a significant brand in the UK electrical retail landscape. In addition to core organic growth, over the years, the organisation has built out their extended value chain capabilities including logistics, financing and recycling.

Group revenues in FY2025 exceeded £1.1bn with like-for-like group revenue (excluding revenues from the MusicMagpie acquisition) up 7% and core B2C retail revenue growing 12% to £832m. Record adjusted profit before tax on a like-for-like basis hit £45m, a chunky 32% jump from the previous year's £34m and comfortably ahead of their upgraded guidance range of £39-44m. Encouragingly, the profit growth outpaced revenue growth, with adjusted profit margins expanding to 4.1% from 3.3% the year prior, clear evidence that the “strategic pivot to profit & cash generation” from 2023 is working out.

Cash flow generation also improved, with free cash flow ticking up 9% to £23m, driven by strong operational performance and what the company describes as "efficient working capital management", i.e. getting paid on time and not tying up cash in excess inventory. The balance sheet remained solid with net funds of £23m at year-end, admittedly down from £34m the previous year, but this was largely due to the circa £35m cash outlay for the MusicMagpie acquisition and funding their employee benefit trust to satisfy share schemes.

AO also secured an expanded £120m revolving credit facility (up from £80m) that runs until October 2028 and remains entirely undrawn, a sign that lenders are sufficiently convinced by the story. The adjusted earnings per share jumped 33% to 5.7p, though statutory earnings per share took a hit primarily due to acquisition-related costs.

With over 650,000 new customers choosing AO for the first time during the year and repeat customers now accounting for more than 60% of orders, the operational momentum continues to be building. Their customer acquisition “flywheel” is spinning faster, and critically, these repeat customers are demonstrably cheaper to acquire and deliver better lifetime value through higher share of wallet across multiple categories.

Mobile Business

Usually, I’d take less of an interest in the network contract commission model given it’s not the focus of this substack. But, the general mobile context is useful and I think indicative of ongoing wider sector pressures. Additionally, given management place significant importance on “mobile”, I am trying to understand what happened between FY2018 and the FY2025 write down and announcement that if they can’t make it work, they’ll close it3.

AO announced the intended acquisition of Mobile Phones Direct (MPD) in December 2018 for a total consideration of £38.1m comprising of £20.4m in cash and 13.1m AO shares valued at £17.2m. MPD finally became a part of the AO group of companies in December 2019. The business was almost entirely focused on broking network connections: in 2018 MPD earned £118.5m in commissions and £3.3m in product sales; had 1.25m customers; established partnerships with all the UK Mobile Network Operators (MNO) and the acquisition hypothesis went as follows:

Further develop AO’s Customer strategic objective by transforming its Mobile

offering.

Entry into a large and important market.

Experienced management team and well-established e-commerce proposition,

underpinned by relationships with UK mobile network operators and handset

distributors

Complementary online business models focused on customer service.

Cash generative business

Opportunities for growth and synergies

As you’d expect, management continued to express satisfaction with acquistision’s performance between 2018 and 2020 and focused on integration by leveraging AO’s operational capabilities. Then the effects of COVID revealed themselves and it became apparent that FY2020 was peak satisfaction and FY2021 peak future revenue.

The mobile commission receivables chart above reveals the scale of the business deterioration. From a peak of £91.5m in FY2021, receivables collapsed 49% to £46.7m by FY2025, representing £44.8m less in expected future cash flows from Mobile Network Operators (MNO). It reflected a fundamental breakdown in the commission model where COVID-19 appeared to break historical assumptions about customer behaviour and demonstrated the pricing control which the MNOs continue to wield in the market. I’m reminded of the Phones4U situation, though clearly different circumstances. AO had to reverse £10.8m of previously recognised revenue in FY2021 due to unexpected contract cancellations and cash back redemption spikes, revealing that their revenue recognition methodology had become inadequate. The accelerating decline from FY2022 onwards provided clear warning that culminated in the inevitable impairment.

Faced with commission receivables disappearing and mounting losses, management addressed the situation this year FY2025 with a full £19.6m impairment comprising £14.7m goodwill and £4.8m intangibles write-off. This represented the complete write down of value from the original £31m acquisition investment, with management citing "structural headwinds" including 13-15% market contraction, disaggregation trends, and intensified competition forcing up acquisition costs. Whether management held onto optimistic assumptions too long after the underlying metrics had turned decisively negative, is now moot and focus has shifted to turning the business around with the 5% PBT margin target in mind, or closing it down.

AO's strategic response centres on launching a Mobile Virtual Network Operator (MVNO). This represents a fundamental shift from retail commission risk to wholesale contract risk. The MVNO model potentially offers more predictable cash flows and reduces exposure to the commission receivables volatility that prompted the write down. This will require new capabilities and assumes AO can leverage its 12.5m customer base more effectively than established MVNOs have managed in an increasingly competitive market. It appears to be working for Curry’s ID Mobile4, so why not? A distraction. Possibly probably.

Recommerce Business

AO’s FY2025 accounts sees the Re-commerce revenue category make its first appearance after the acquisition of MusicMagpie at the end of last year. Whilst fulfilling my consolidation narrative, when announced last October, my only positive was that it provided some (bottom-end) financial data for comparables5. At 0.18x revenue and 3.4x 2023 adjusted EBITDA, the valuation confirmed distressed asset pricing, which nobody really wants to see in their own sector. Under AO ownership, MusicMagpie contributed £29.7m revenue in 3.6 months, extrapolating to approximately £99m annualised, which if anywhere near accurate suggests a 28% decline from their 2023 run rate and indicating continued pressure.

Management’s hypothesis revealed in the FY2025 filing was relatively vague:

Enhance the consumer tech proposition

Offer a differentiated service to customers

Unlock value through reverse supply chain

Advancing sustainability objectives

So without understanding the detail, the intentions are superficially valid but, the acquisition occurs against deteriorating recommerce fundamentals that extend beyond company-specific challenges. CCS Insight reports Q1 2025 saw the organised second-hand smartphone markets decline across key regions6. This supports the broader smartphone market dynamics where consumer intentions to extend average ownership from 3.4 to 3.67 years could drive a 9% UK market contraction by 20287.

As the structural correction takes place, AO will face significant competition in securing device supply. Samsung’s future value guarantee, increased MNO participation and further participation from the likes of Alchemy and Foxway will force further margin contraction. And, as traders are well aware, this isn’t a simple buyback from the the consumer process, there’s a significant amount of daily B2B trading required in order to secure supply.

Therefore, for AO to capitalise on their investment, in-house repair and refurbishing capability will need continued investment in automation and new capabilities to process categories beyond phones at scale. Managements’s longer term intention for improving the affordability of many products on AO.com is desirable but is not a natural consequence of the acquisition.

Whilst recognising it’s still early, the immediate financial impact reveals margin dynamics that will require careful management. MusicMagpie's historical gross margins show strength and volatility: 29.2% (2020); 30.4% (2021); 26.3% (2022) and; 27.7% (2023), consistently outperforming both AO's traditional retail margins (18-20%) and ElekDirect's 15.9% margin. However, whilst the total re-commerce revenue increased to £42.6m (FY2025) from £10.6m (FY2024), MusicMagpie's £29.7m contribution alongside £1.7m losses suggests translating the superior gross margins into operating profit has some way to go. Additionally, the acquisition accounting allocated £11.2m to intangible assets (£7.2m marketing, £4.0m technology), creating future amortisation charges that may further pressure reported profitability.

Operational metrics will prove equally critical in assessing integration success. MusicMagpie's historical device processing volumes, refurbishment success rates, and average selling prices provide baseline performance indicators that AO must maintain while achieving synergies. The revenue per device and gross margin per category (smartphones, tablets, gaming, physical media) will reveal whether AO can improve MusicMagpie's unit economics through preferred sourcing. Customer acquisition costs for the combined recommerce offering, trade-in attachment rates from AO's existing customer base, and cross-selling conversion metrics will determine whether the tech and differentiation theses materialise.

With extended ownership cycles reducing device supply and competitive pressures intensifying, monitoring market share gains against margin compression becomes essential; success requires demonstrating that operational improvements can offset structural headwinds rather than simply adding revenue to a declining margin business.

Protection Plans

Whilst the acquisitive side of AO’s business strategy may have room for improvement, as I stated up top, core sales in the B2C and B2B categories is humming along nicely. That’s good news for AOCare, the protection plan programme and this is even better news for Domestic & General, the incumbent insurer and programme manager, who have just had the contract extended until 20338.

With each active plan representing an average of £88 in remaining future commission value to AO, and assuming typical protection plan commission rates of 40-50%, the underlying annual customer programme can be estimated at approximately £67 million. This calculation assumes around 200,000 new plans sold annually (based on historical growth trends and cancellation patterns), which would imply average customer premiums of roughly £47 per year if spread over a 7-year average plan life. Such pricing would represent an 8.3% attachment rate against AO's £798 million product revenue base.

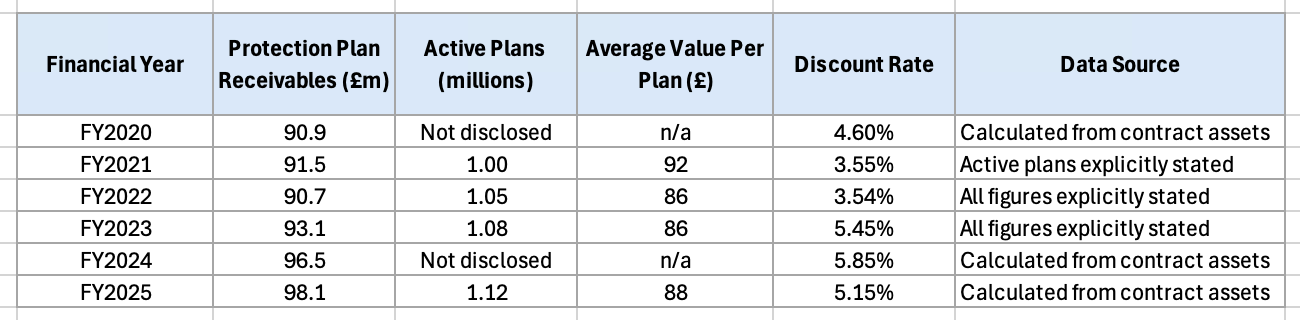

Discount rate volatility from 4.6% in FY2020 peaking at 5.85% in FY2024 before declining to 5.15% in FY2025 directly impacts the present value calculations underlying the £98.1 million receivables balance. Each 100 basis point change potentially affecting valuations by several million pounds based on the long-term cash flow streams inherent in indefinite-duration plans.

Historical data indicates a maturing business with steady volume growth despite some value compression per plan. Active plans have grown 12% from 1.0 million in FY2021 to 1.12 million in FY2025, while total receivables increased 7.2% from £91.5 million to £98.1 million over the same period. However, the average remaining value per plan has declined from £92 to £88, suggesting either a shift toward lower-value products, or more likely pricing pressure as claim inflation has accelerated over the last few years.

A quick scan of the AOCare Terms and Conditions reveals that policies "continue indefinitely until cancelled" with monthly Direct Debit payments that remain stable for at least two years, followed by annual reviews that enable gradual price increases. After purchasing an appliance from AO, D&G contacts the customer to offer AO Care. There’s a 45-day cooling-off period in which consumers are entitled to a full refund and after which no refunds are available.

The protection plan business demonstrates consistent operational performance across key metrics. The programme maintains 1.12 million active plans with £98.1 million in future commission receivables, representing stable growth in customer base and contracted revenue streams. With commission rates estimated at 40-50% and annual customer premiums calculated at approximately £47, the business generates material cash flows for AO while providing affordable coverage for customers.

The indefinite duration structure and monthly payment model create predictable revenue patterns, while the D&G partnership extension to 2033 provides long-term operational stability. Discount rate sensitivity affects receivables valuation, though the underlying business fundamentals appear resilient to macroeconomic fluctuations. The programme's integration with AO's core retail operations positions it to benefit from continued growth in the company's expanding product categories.

Summary

Management appear to well on track with their pivot from growth to cash generation and profitability. Strong retail momentum with record profits and expanding margins have provided a decent buffer against significant deterioration in the mobile business but challenging recommerce market conditions suggest that the core business may still have some heavy lifting to do. With the interim results due in November, I’m sure analysts will be looking to management for a decision on the mobile turnaround strategy or confirmation of the closure plans. I’ll certainly be keeping an eye out for more news on the MusicMagpie integration and whether the “wooden dollars” capability transaction was indeed a “great deal” or if they acquired another millstone.

Peace,

sb.

Peel Hunt, Jefferies & Co, Investec, Shore Capital and Cannacord Genuity to name a few.

Thanks for the in depth analysis, interesting to see a company with such a wide mix of businesses. Is the pivot towards MVNO also to capture potentially lucrative software and services revenue that can come from that business? The general sense I get is that the profits device trading alone is getting tougher, divesifying into other more lucrative revenue streams (insurance, internet services, etc) is a natural move.