Consumer behaviour in secondary markets

Traditional segmentation need not apply, if you're looking for phones, get out your Clubcard.

I know many of you operate in a B2B2C environment and your partners up the value chain will always have distinct approaches to their own customer base. However, wherever you sit, it’s usually worth taking a few moments to understand consumer segmentation and behaviour. I’ve recently referred to a survey I ran prior to a client engagement at the end of May. There were a couple of highlights from the data which included further confirmation of extending lifecycles1 and additional context to the flurry of residual value guarantee announcements at the end of last month2.

The survey consisted of a nationally representative sample of 500 UK consumers via the YouGov platform who were asked the following:

Where did you purchase you last mobile phone?

Was the last mobile phone that you purchased new, refurbished or secondhand?

When you purchased your latest phone, did you trade-in your old phone?

How long had you kept your previous mobile phone for?

How long do you intend to keep your new mobile phone for?

When you purchased your latest mobile phone, did you buy mobile phone insurance with it?

The YouGov platform is a decent bit of kit and, in addition to facilitating the primary responses, it provides a significant amount of demographic and behavioural data to keep the likes of me glued to my laptop screen for several weeks. So for the marketeers, growth and operational strategists amongst you and of course the Kotler & Keller fans, here are a few takes on the full data set:

1. Where did you purchase you last mobile phone?

GenZ (35.1% secondhand/refurbished): show the highest preference for secondhand/refurbished channels. Given this group also show the least propensity for recycling, I suspect the purchase decision is driven by cost consciousness. There’s also notable direct manufacturer usage (24.6%) but, unfortunately, payment methods are unclear from the survey, so I’m not able to tell if, or how, these purchases were financed.

Millennials (33.8% carriers): prefer carriers but show more balanced distribution across channels than the other generations. Their buying behaviours represent a clear transition between the younger and older cohorts.

Gen X (39.8% carriers): had the highest preference for purchasing devices at carriers, which probably reflects some level of habitual buying and or brand loyalty. There’s a slight preference for multichannel retail, but otherwise the buying preference is evenly spread.

Baby Boomers (23.5% secondhand/refurbished): had the second-highest preference for secondhand/refurbished channels. I’m assuming this is driven by value-consciousness rather than brand aspiration.

Generational channel preferences are clearly evident. GenZ's combination of high secondhand/refurbished usage alongside notable manufacturer direct purchasing suggests they're finding ways to access premium brands affordably, though I can't determine the specific financial mechanisms from this data. Their behaviour contrasts sharply with older generations who rely more heavily on traditional carrier relationships.

2. Was the last mobile phone that you purchased new, refurbished or secondhand?

The decision to purchase a refurbished or secondhand mobile rather than a new one appears to defy simple demographic classification. The survey results reveal a market driven by nuanced behavioural patterns rather than traditional customer segments.

A u-shaped age paradox: evidence of segmentation complexity emerges in age-based purchasing patterns. Both the youngest (18-24) and oldest (65+) consumers show the highest adoption rates for non-new phones at 21.2% and 22.6% respectively, whilst middle-aged groups demonstrate significantly lower rates. The 45-54 demographic shows the lowest adoption at just 9.7%. This U-shaped distribution suggests entirely different motivations across age groups: young adults may be driven by budget constraints and environmental consciousness, while older consumers might prioritise value with looser attachment to acquiring the latest technology.

Income as value signal, not price sensitivity: perhaps more surprisingly, income patterns reveal that refurbished or secondhand phone purchasing isn't simply about affordability. The highest adoption rate appears among £50,000-£60,000 earners at 22.1%, while lower-income brackets like £30,000-£35,000 show only a 6.6% adoption. This feels counterintuitive and suggests that for upper-middle-income consumers, choosing refurbished phones represents a careful value calculation, possibly viewing refurbished devices as a smart purchase choice delivering premium quality at a discount.

Gender-neutral decision making: there was no meaningful gender difference (14.6% male vs 15.1% female adoption) which further complicates traditional segmentation. The near-identical preferences indicates that sustainable phone purchasing requires focus on behavioural and motivational factors.

Multiple motivation pathways: the data hints at three interwoven pathways to sustainable phone adoption: environmental consciousness (evidenced by the correlation with heavier recycling behaviour), value optimisation (shown in the upper-middle income peak), and price sensitivity (demonstrated in pay-as-you-go user preferences). These pathways may overlap within individual consumers but require different messaging and positioning.

Sustainability doesn’t fit into simple segmentation. Rather than targeting broad demographic segments, the sustainable phone market appears to require behavioural segmentation that identifies consumers based on their relationship with technology, environmental values and financial decision-making.

3. When you purchased your latest phone, did you trade-in your old phone?

The income chasm: perhaps the most striking finding in responses to this question emerges from household income analysis. Consumers earning £70,000-£100,000 annually trade in their devices at a rate of 22.6%, while those earning £20,000-£25,000 participate at just 3.8%. This six-fold difference suggests that trade-in programs are structured in ways that don’t appear to help those who might benefit the most.

The pattern repeats across option availability. Higher-income households not only participate more when options are available, but they're also more likely to encounter trade-in opportunities in the first place. There’s a compounding effect where more affluent consumers benefit from both better access and higher participation rates.

The generational surprise: conventional wisdom might suggest that digitally native GenZ consumers would lead trade-in adoption, yet the data tells a different story. Millennials, with their 19.8% trade-in rate, significantly outperform GenZ's 11.3% participation. This points to experience and financial stability trumping digital confidence when it comes to trade-in behaviour. The age analysis reinforces this pattern. The 25-34 demographic achieves the highest trade-in rate at 25.7%, representing consumers who combine peak smartphone upgrade frequency with growing disposable income. Meanwhile, the youngest adults (18-24) show the lowest participation at just 4.3%.

Gender and geography: female consumers demonstrate a 2.7 percentage point advantage over males in trade-in participation. Whilst small, the gap suggests that value-consciousness and practical financial considerations may drive trade-in decisions more than technology enthusiasm. Geographic patterns reveal urban consumers trading in at 15.2% compared to rural counterparts at 11.1%. However, the difference extends beyond participation rates to option availability itself. Urban consumers encounter trade-in opportunities 45.8% of the time versus just 33.5% for rural consumers, indicating infrastructure and convenience barriers beyond simple preference differences.

The conversion challenge: while much attention focuses on expanding trade-in option availability, the data reveals that 29.6% of consumers had options available but chose not to use them. With a conversion rate of just 32.5% among those presented with trade-in opportunities, there's room for improvement in program design and incentive structures. Perhaps the developing forward guarantee products will address this. This conversion challenge varies significantly across demographics. Higher-income consumers not only encounter more options but convert at higher rates when they do. Lower-income consumers face a double disadvantage: fewer opportunities and lower conversion when opportunities arise.

The demographic stratification suggests that trade-in market expansion requires different approaches for different consumer segments. For affluent millennials, the focus should be on premium experiences and enhanced convenience. For lower-income consumers, the priority must be removing barriers and simplifying processes.

4. How long had you kept your previous mobile phone for? & 5. How long do you intend to keep your new mobile phone for?

The more important strategic shift identified from consumer responses to these questions is covered here. However, there are a couple of additional demographic and behavioural insights worth mentioning.

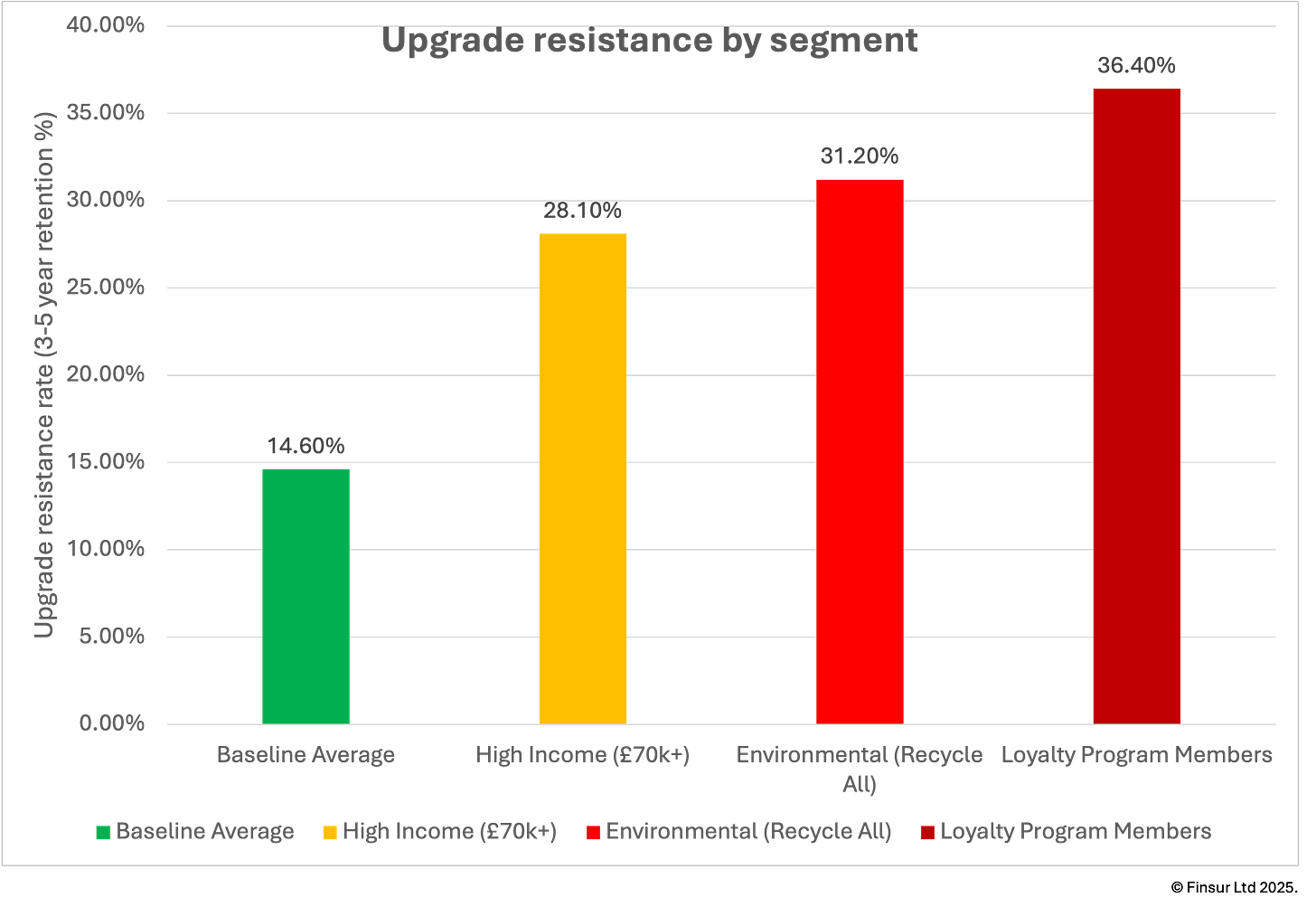

The loyalty paradox: retail loyalty program members exhibit the strongest upgrade resistance, with 36.4% maintaining devices for 3-5 years versus 14.6% baseline rates. This paradox suggests that consumers demonstrating loyalty to retail brands extend that loyalty behaviour to their devices. Trade-in operators targeting this 18% market segment require enhanced forward guarantee propositions, as standard depreciation models fail to overcome their retention bias.

The repair revenue opportunity: environmental consciousness correlates strongly with extended ownership intentions, creating sustained demand for premium repair services. Users planning 5+ year retention cycles represent a higher lifetime value repair customer, willing to invest in device maintenance rather than replacement. This segment shows 31.2% retention rates, nearly double the market baseline, indicating consistent revenue opportunities across extended device lifecycles.

Extended coverage dynamics: longer retention intentions fundamentally alter insurance risk profiles and revenue models. Retention-focused segments demonstrate higher attachment rates whilst extending policy duration, creating improved lifetime customer value despite slower policy churn. The correlation data reveals that environmental and loyalty-conscious consumers view insurance as device longevity enablement rather than short-term protection.

Supply chain implications: the combined effect of loyalty program membership and environmental consciousness affects approximately 30% of consumers, creating measurable supply constraints for refurbished device markets. These segments show consistent patterns of extended primary ownership, reducing secondary market availability. Marketplace operators must secure inventory earlier in device lifecycles, before retention behaviours solidify.

Industry adaptation requires embracing rather than resisting these behavioural shifts. Successful players will capture value from extended lifecycles through enhanced repair services, premium trade-in programs, and innovative circular economy solutions, rather than attempting to accelerate replacement cycles that consumers increasingly view as environmentally irresponsible.

6. When you purchased your latest mobile phone, did you buy mobile phone insurance with it?

Modest gender differences: While men and women show some differences in mobile phone insurance behaviour, the gaps are relatively modest. Men show a slight preference for purchasing insurance directly at the point of sale (57% versus 43%), and this pattern extends to banking insurance products and relying on home insurance coverage, though the differences remain in the single digits.

The most notable gender difference appears when customers decline insurance offers, where women account for 55% of declined offers compared to men's 45%. However, these 10-15 percentage point differences suggest that gender alone isn't a strong predictor of insurance selection with other factors likely playing larger roles in purchase decisions.

The age factor: Age reveals more interesting patterns in insurance behaviour. Middle-aged customers between 35-54 years old represent the sweet spot for direct insurance purchases, making up 39% of buyers, significantly higher than younger adults at 28% and seniors at 33%. However, this same demographic also leads in declining insurance offers, suggesting they're confident decision-makers who know what they want.

Confused coverage: it’s probably obvious, but the data supports a key correlation with home insurance cover. While only 12% of young adults rely on their home insurance to cover their mobile phones, this figure jumps to 28% for middle-aged customers and rockets to 61% for those over 55. However, there is a potential vulnerability, it’s unclear whether consumers assume their home insurance provides cover or if they’ve actively selected an “away from home” or “personal” possessions add on.

Youth paradox: young adults present an interesting opportunity. They show the lowest decline rates when offered insurance (20% compared to 40% for middle-aged customers), suggesting greater receptiveness to new products. However, they're also least likely to have comprehensive home insurance coverage, creating a genuine protection gap.

Packaged banks accounts still have their place: banking insurance tells another story entirely. Middle-aged customers dominate this space at 47% adoption, compared to 23% for young adults and 30% for seniors. This reflects the peak earning and banking relationship years when bundled products become most attractive.

Other patterns: environmental consciousness correlates strongly with insurance behaviour, though not always in expected ways. Those with bank account insurance show the highest recycling rates at 84%, followed closely by home insurance reliers at 81%. Direct insurance purchasers show moderate environmental consciousness at 52%, while those who declined insurance offers score lowest at 46% for high recycling behaviour.

Loyalty program memberships reveal distinct consumer profiles. Tesco loyalty members are most likely to rely on home insurance coverage (31% membership), while Amazon Prime members gravitate toward bank insurance products (20% membership). These patterns suggest that shopping behaviours and insurance preferences may be more connected than previously understood.

Summary

The survey data reveals a secondary market far more nuanced than traditional demographic segmentation suggests. From GenZ's strategic pursuit of premium brands through secondhand channels to the surprising income patterns in refurbished phone adoption, consumer behaviour defies simple categorisation. The trade-in inequality between high and low-income households, combined with the conversion challenges even when options are available, highlights structural market inefficiencies. Meanwhile, insurance purchasing patterns demonstrate how life stage and financial sophistication influence protection choices more than age alone. These findings collectively point to a market requiring behavioural rather than demographic targeting, where understanding motivational pathways, whether environmental consciousness, value optimisation, or financial necessity, becomes critical for effective engagement across the secondary market.

If you’d like to dive deeper into these insights or discuss how they apply to your specific market strategy feel free to drop me a line to discuss custom research, strategy sessions, or how these behavioural patterns might impact your business model. I’m keen to hear any additional evidence be it data based or anecdotal, so please feel free to comment below too.

Peace,

sb

P.S. Despite me taking several days to recover, the 24 hour run was awesome. We came 9th out of 147 in our mixed small team category. Many pot noodles were consumed.

Great stuff, thanks for sharing.

What are packaged bank account insurances? Is it device insurance products linked to customers banking account?

The data point on more affluent users being more likely to trade-in at such a huge disparity is interesting. My initial guess would be they would be less likely to trade-in because they can afford to keep their device as a spare or pass down to a relative. The point you have trade-in opportunities likely explains the variance though.

Maybe more affluent users are also more likely to have a device with a higher re-sale value worth trading in than less aflfuent users? Less affluent users may not only lack the opportunities to trade-in because of channel but the trade-in value of their device is much lower so they think its more valuable to keep it as a spare than discount it on their next purchase.

Beyond the economics though, i agree with you that change needs to happen at the behavioral and kind of mindset level of consumers. We should try to educate wider public to look to trade-in your device even if there is not huge monetary incentive (low-end phones) to do so because it is better our environment.

Just using my family and relatives as a small sample size, none of them have ever traded in a phone. I see so many spare phones in drawers and all around the house, i even saw a nokia 3310 other day. The reason of keeping those phones is its better to have spares in case of emergencies or to pass down to younger relatives.