December Round Up

Peril begins with PE...

Happy New Year to all of you secondary market activists and entrepreneurs, insurers, operators and commentators. May 2026 bring peace to those without it and prosperity to those that need it. For the sake of my own prosperity, new subscription pricing took effect from the 1st of January: £12/month, £120/year or £495/year for corporate teams. Existing subscribers are locked in at current rates permanently. For organisations with multiple team members regularly reading this substack, the Corporate tier includes unlimited access. Please contact me if this is a better option for your business, especially those I know with 5, 10, 15+ team members all subscribed. Individual company and market reports are also now available at reports.finsur.co.uk for those who prefer one-off purchases.

All future Company, Strategy and Market analysis articles will be behind the paywall with monthly round ups and selected articles on the free tier. So, with that here’s a selection of news items in December that didn’t quite make it to a full article (yet).

Market

I’m not sure why a July article from NIQ popped up in my December feed, but I’m glad it did. According to their rather thin content marketing piece, nearly 10% of all Q1 2025 smartphones sold in the UK were refurbished1. This means I’ll have to stop quoting their historic estimate of 25% of all UK mobile phones sold being refurbished2 as an outlier. Their methodology is not published, but they are keen to let us know that “The refurbished tech market is no longer a niche - it’s a fast-scaling, data-rich opportunity reshaping the T&D landscape”. Fancy. If you’re looking for a number, try here.

Lots of great discussion at the CCS webinar on Telco Strategic Priorities in 20263 covering the rise of fintech MVNOs including Revolut’s upcoming offer, increasing M&A activity, specifically European Operator consolidation and of course devices. Ben Wood suggested that whilst consumers don’t appear to be driving AI-native device demand, AI-native devices are driving increased memory requirements which will inevitably push up new device prices. I’d suggest that any price hike in new devices will further benefit the secondary market. I appreciated the confirmation that I’ve not been talking complete drivel about new device sales being flat and it was suggested there might even be a dip in 2026, but again, that’s likely to be to the advantage of the secondary market with a forecasted 7% CAGR to 2029 in organised market sell-out volume. Without understanding the methodology this feels far more realistic than some of the outrageous numbers peddled by non-specialist research firms. There was also some decent commentary on operator target performance for device take-back highlighting just how far behind they are (as an industry) the GSMA (voluntary) pace-setting targets announced back in 20234 and covered in detail here. Whilst getting back on track might be out of the question, the importance of sourcing quality devices will be one area covered at the upcoming CCS Circular Economy event on 4th February in London. See you there.

Aside from the astonishing complexity, I agree with much of the EU regulation around the secondary market. In principle, their latest move to narrow the scope of corporate sustainability reporting requirements and supply chain due diligence should ease the burden on smaller firms with the new thresholds and restrictions applying as follows5:

Sustainability Reporting:

Now applies only to EU companies with >1,000 employees AND >€450m net annual turnover (previously much broader)

Non-EU companies: >€450m in EU net sales

EU subsidiaries/branches: >€200m EU sales threshold

Explicit “trickle-down” protection: firms below 1,000 employees cannot have reporting responsibilities shifted onto them by larger business partners

European Commission to establish a digital portal with templates and guidance

Corporate Due Diligence:

Applies only to the largest companies: >5,000 employees AND >€1.5bn net annual turnover

In-scope companies may only request information from smaller partners “where necessary for a thorough assessment”

Transition plans to align with sustainable economy are no longer mandatory

Penalties capped at 3% of global net revenue, liability handled nationally

Implementation delayed to 26 July 2029

The latest move is a part of the Omnibus I regulatory simplification(?) and combined with the pause on the Green Claims Directive represents a weakening of the EU's sustainability architecture. The 2029 implementation date for due diligence pushes effective enforcement well into the next decade and the EU appears to be backing away from sustainability regulation at the very moment circular economy requirements are supposedly ramping up. Odd. Unless of course, the market, i.e. you lot, are getting there anyway.

The Ellen MacArthur Foundation (“EMF”) published Keep it in use: Retain resource value and unlock economic opportunities (11 December)6, highlighting that many existing Extended Producer Responsibility (“EPR”) schemes are de facto geared towards recycling and waste-to-energy rather than maximising reuse and remanufacturing potential. The consumer electronics secondary market illustrates both the limits and the opportunities of that critique. The refurbishment sector for smartphones, laptops and tablets has developed commercially, driven partly by trade-in economics and resale demand and largely without policy support. Premium device refurbishment is now a competitive, margin-compressed market precisely because it works, so generic intervention here would risk subsidising what already functions rather than raising circular ambition. The real gaps in this sector are elsewhere: lower-value devices where refurbishment economics are viable but demand is absent, and entire categories of wearables, smartwatches and IoT devices where functional returns may default to recycling because repairability is so poor. This is where policy can make a difference. The EU's Ecodesign for Sustainable Products Regulation (ESPR) goes some way toward addressing this, mandating repairability requirements, spare parts availability, and software support for smartphones and tablets, while EPR design concepts such as eco‑modulated fees explicitly aim to link product characteristics to economic signals at end of life. But ESPR governs product design at point of manufacture while WEEE governs end-of-life, and the two aren’t yet connected in practice: a device meeting all ESPR repairability requirements still generates the same EPR obligation as one that doesn’t, so the economic signal remains weak, and ESPR’s current product scope doesn’t extend to many of the categories where recycling is the default. The principle should be straightforward: policy should plug the gaps the market won’t fill and make existing instruments work together, not bluntly subsidise what already works. That means linking design compliance to end-of-life economics through robust eco‑modulation of fees and extending coverage to the product categories currently falling through both frameworks. There’s probably an article worth exploring here, if there’s any interest?

Companies

First up, the reports that Exertis plan to cut over 1,000 jobs after the buyout by PE firm Aurelius must have been extremely concerning for everyone potentially impacted789. Nobody needs that type of news ever, let alone before Christmas. Whilst their namesake never wrote about leveraged carve‑outs, he did warn that “what doesn’t transmit light creates its own darkness”, which feels on point for this absolute car crash of sequencing and signalling: buy a low‑margin, credit‑sensitive distributor in a tight trade‑credit market in which you already have form (Bodyshop, Lloyds Pharmacy), then almost immediately let the CEO go, spook staff, suppliers and insurers with a near‑wipeout UK restructure, while leaving higher‑value, strategically on‑trend bits like MTR Group sitting there unmentioned. I’m sure they’re all very smart people, but from the outside, it reads like they don’t know what the fuck they’re doing. All the best to those adversely affected.

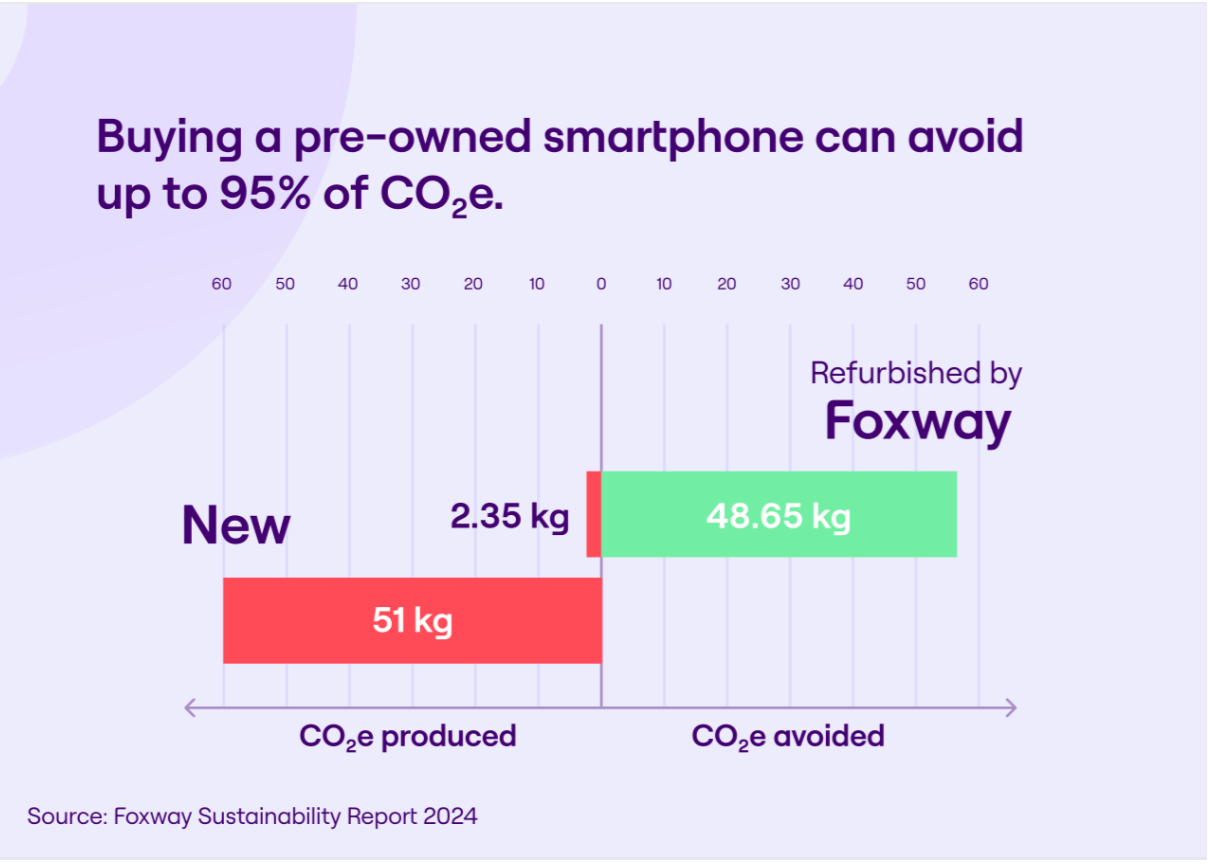

A 3-month old post from Foxway (re)appeared on my LinkedIn feed this month10, reminding me that getting your head around the social media algorithms can be frustrating. One particular slide caught my attention and will perhaps come to the attention of Sara Linstrand, their new Chief Sustainability Officer, joining in Q1 202611. With the apparent record sales of iPhone 17s12, someone needs to explain to me how exactly buying pre-owned can save up to 95g CO2e. Now whilst the slide was from Foxway’s 2024 sustainability report, we need to be increasingly careful with such statements. Consider the use phase by all means, but there is no direct link between buying a refurbished device and a new device not being manufactured.

Google launched the Pixel Upgrade Program in India in December, offering guaranteed buyback on the Pixel 10 series purchased through 24-month no-cost EMI financing13. The structure is familiar: upgrade eligible between months 9 and 15, with Cashify guaranteeing to credit the remaining loan balance regardless of device condition (provided it powers on and has no unauthorised repairs). More evidence to validate the CCS Insight’s Prediction 62 that one in four premium smartphone launches will include integrated buyback or upgrade offers by 202614, positioning guaranteed residual value alongside product features rather than burying trade-in in checkout flows. What’s notable is the partnership model. Rather than using a global processor, Google has partnered with Cashify, India’s largest domestic trade-in and refurbishment platform, embedding the programme into existing local secondary market infrastructure. There’s no detail on the “Accidental damage cover at no extra cost when you decide to upgrade”, so it’s possible Cashify internalise the risk because devices are only 9-15 months old at trade-in, damaged Pixels retain meaningful refurbishment value, and they control the entire processing pipeline. Good stuff.

SquareTrade extended their long-term US partnership with Costco to include Japan15. The deal covers Costco Japan’s 37 warehouse stores and coverage spans laptops, tablets, game consoles, TVs, refrigerators, washing machines, and dishwashers, including accidental damage on select portable electronics. The partnership expands SquareTrade's Japan footprint beyond mobile carriers. They already partner with SoftBank on Google Pixel protection (reportedly the first time SoftBank outsourced device protection). CEO Karl Wiley has previously noted that Japanese consumers are "very risk averse" with high device protection attachment rates, but have been "tolerating incredibly bad service" including two-week repair turnarounds. The Costco deal positions SquareTrade to address the retail channel with faster replacement options and their global service infrastructure, competing against local warranty providers in a market Wiley described as "about five years behind" the US on service speed. Whilst not transformational, this is likely to provide a meaningful addition to SquareTrade’s international revenue contribution16.

Another flavour of handset BNPL made its way into the market via Verizon’s branded prepaid offer Total Wireless17. Whilst touted as a “groundbreaking” moment for prepaid, if you strip away the marketing it looks more like a cleaned‑up version of postpaid handset financing pushed down into Verizon’s Value base with a Glow Services powered POS stack and some clever loyalty optics. Loans are originated by Utah’s First Electronic Bank at up to 24.9% APR, then cosmetically softened by Total Wireless bill credits so the customer can be told their mid‑tier iPhone costs “as low as $0 a month,” which is more about presentation than genuine disruption. The genuinely positive angle is that long‑tenured prepaid customers who were previously stuck on cash‑and‑carry or rent‑to‑own now get access to mainstream‑style instalment plans on semi‑sensible terms, underwritten on behaviour rather than just a FICO score, but that’s an overdue catch‑up, not a revolution. Glow and its ever‑ebullient chairman can fairly claim a timely Tier‑1 logo with a sizeable non‑contract addressable base after their recent $65m raise for the old boys’ club18. However, the underlying model remains a fairly standard mix of bank‑funded device loans, promotional credits and loyalty mechanics, dressed up in “telecom AI cloud” language that flatters the plumbing.

Servify expanded its AT&T Business Protect programme with Enterprise tier pricing targeting companies with 1,000+ devices19. The move highlights AT&T's increasingly bifurcated approach to B2B device protection: Asurion powers the SMB-focused Protect Advantage for Business (including loss/theft coverage underwritten by CNA), while India-headquartered Servify handles the broader Business Protect portfolio with warranty-only coverage and a platform play emphasising AI-powered claims fulfilment. The Enterprise tier adds volume discounts, dedicated account management, and SaaS integration for fleet management, standard enterprise features dressed in 'agentic tech support' language. Servify continues to nibble away at Asurion's dominance in North American carrier device protection, though the segmentation suggests AT&T is comfortable compartmentalising rather than replacing its incumbent partner.

iFixit launched FixBot20, an AI repair assistant that draws on their library of 125,000 community-written repair guides, Q&A posts, and service manuals. The tool handles voice, text, and image input to diagnose problems and surface relevant parts and guides, positioning against generic AI chatbots by claiming better accuracy through grounding in verified repair documentation. The inevitable tension surfaced immediately in the comments: FixBot is built on community contributions, but if users default to AI rather than forum posts, the source material stops growing. iFixit's response, that it will handle repetitive questions and free up the community for interesting problems, is certainly plausible. Free at launch with a freemium model planned.

Orange Poland launched 'Insure with Orange'21, a digital insurance comparison platform built on bolttech's technology. The platform covers motor and home insurance at launch, allowing customers to compare quotes from a panel of insurers and complete purchases online or via phone support. Positioned as Poland's first telco-led insurance comparison service, it follows bolttech's familiar embedded distribution playbook leveraging Orange's customer relationships and digital channels to cross-sell general insurance. Perhaps this time I’ll be convinced that telco brand stretch extends to general insurance without snapping, but if Telefónica’s attempt at home insurance is anything to go by, I may have to wait a bit longer.

Maxis Malaysia launched its Yearly Upgrade programme (November), enabling iPhone customers on Zerolution financing to swap for the latest model once they reach the final 12 months of their contract—no early termination fees if the device passes inspection. Unlike Apple's direct iPhone Upgrade Program in the US, this is carrier-led: Maxis owns the financing relationship, captures the trade-in, and controls the upgrade trigger. But the programme is iPhone-exclusive, which suggests Apple benefits from accelerated upgrade cycles without having to operate financing infrastructure. The carrier defends its relevance in the device lifecycle while effectively facilitating Apple's annual release cadence. Three months of free Maxis Device Care Plus sweetens the bundle and hints at the broader carrier playbook: device financing, protection, and trade-in as an integrated retention stack.

Investments

Clearly the biggest news in December was the announcement that Asurion plan to acquire Domestic & General for £2.1bn22. I covered it at the time and published full analysis here.

In the overall secondary market scheme of things, the rumour that Chubb have offered to acquire AIG is a non-event23. But, whilst AIG’s global AppleCare Plus programme is a relatively small account with the general insurance market, it would represent a significant shift in power of mobile insurance providers. Chubb already have a number of sizeable accounts in Europe including Vodafone in Germany, Sunrise in Switzerland and KPN in the Netherlands. My perception has always been that Chubb’s success in the device protection market has been hamstrung by their non-specialist categorisation, but adding the Apple account would fully negate that critique and position them as a serious contender for a top 5 position.

bolttech acquired mTek, a Kenyan digital insurance comparison platform founded in 2019, expanding its African footprint24. mTek’s platform serves 350,000+ customers comparing quotes from 45+ insurers including GA Insurance, Sanlam, and Britam, and recently partnered with Mastercard on embedded insurance for East Africa. CEO Bente Krogmann stays on to lead regional operations as bolttech positions Kenya as its African beachhead. If that wasn’t enough, they then announced a strategic partnership with Kyobo Lifeplanet25, Korea’s only digital life insurer, to integrate Kyobo’s Laplay health rewards platform and Barun Plan products with bolttech’s embedded distribution infrastructure.

Cashify confirmed Dubai as its international sales and sourcing hub after a year in stealth mode, with India remaining the refurbishment backbone. Co-founder Nakul Kumar also announced Saudi Arabia expansion, positioning the company for GCC growth while targeting 300+ retail stores and projecting 30-35% expansion in 202626. The dual-hub model supports India’s ambitions as a global remanufacturing centre while unlocking premium device supply from Gulf markets.

Foxway co-founders Stefan Nilsson and Martin Backman are launching Ramn, an investment vehicle targeting profitable companies with SEK 25-150M turnover rather than startups27. The pair plan to apply what they call “the Foxway playbook”, multi-lifecycle business models, values-first product decisions, and industrial-scale circularity, to mature businesses in earth observation and circular economy verticals. Nilsson expressed fatigue with circularity buzzwords: “I’ve heard the word so much I’m tired of it. Much of it is pure fake.” Quite.

Right, 27 footnotes is way too many, I’ll not try so hard next month.

Peace,

sb.

"there is no direct link between buying a refurbished device and a new device not being manufactured." - agree on this. Directionally it makes sense, logically every refurbished phone sold equals to one new one new phone not being sold, which should mean one less device manufactured. But in reality markets are not that efficient or easy to track. Structurally the biggest issue is that many of the major OEMs (Apple, Samsung, Xiaomi) are public listed companies with quarterly targets, and a majority of their sales revenue comes from sale of new devices. In the longer term horizon when service revenue becomes a bigger part of their revenue and profit mix it may change. It could also be sped up if they all become not-for-profit companies and dont need to report quarterly earnings to shareholders i suppose ;)