UK Mobile Device Market 2025: Apple's Refurbished Dominance and Channel Consolidation

Annual consumer survey reveals refurbished market segmentation, marketplace disruption, and lifecycle extension. Part 1 of 2: Device purchasing patterns (n=1,001)

Key finding: UK consumers continue extending device ownership towards 3.67 years, representing an 8% market contraction risk. Apple captures 56.5% of refurbished sales despite 43.1% overall market share, whilst marketplace channels now account for 46.1% of all refurb distribution, traditional retail operates at just 5-7% refurb mix.

About this time last year I ran a consumer survey to determine if there was any difference in insurance attachment rates between new and refurbished mobile phones1. It turns out there was:

Customers buying a new phone were 12 times more likely to see an offer for insurance than those buying a refurbished phone.

When an insurance offer was made, new phone customers were 40% more likely to buy it.

Buyers of new phones were 1.4 times more likely to acquire insurance after their phone purchase than buyers of refurbished phones.

The survey also kicked up some useful data on device purchasing and began to highlight a shift away from consumers buying phones from the usual telecoms companies.

This year, I’ve run the survey again, with a larger sample size (n=1000) and a few more questions so I’m splitting the results over two articles. This one covers the device findings and Part 2 next week will focus on the insurance findings.

Headline Stability

UK Mobile Device Market 2025: Key Metrics

- Sample Size: n=1,001 UK consumers

- Refurbished Device Share: 15.4% (2024: 15.8%)

- Telco Channel Share: 39.2% (2024: 39.0%)

- Apple Overall Market Share: 43.1%

- Apple Refurb Share: 56.5% (vs 43.1% overall)

- Apple Refurb Adoption: 20.2% (Samsung: 11.9%)

- Quality-Focused Refurb Buyers: 63% choosing pristine/certified

- Modal Replacement Cycle: 3-4 years (51.5% of respondents)

- Extended Ownership (5+ years): 23.9%

Source: Finsur UK Mobile Device Market Survey, October 2025

At the high level, the main indicators have remained pretty much stable. Consumers choosing to purchase a refurbished device declined very slightly from 15.8% in 2024 to 15.4% in 2025. The Telco channel remains the preferred point of purchase and up just a touch from 39% of consumers in 2024 to 39.2% this time around. Apple maintain their position as the favoured phone brand at 43% share with Samsung following at 36% making for a combined duopoly of 79%. But, beneath the surface stability, consumer behaviours within these segments show more variation.

Deeper Insights

Channel Share

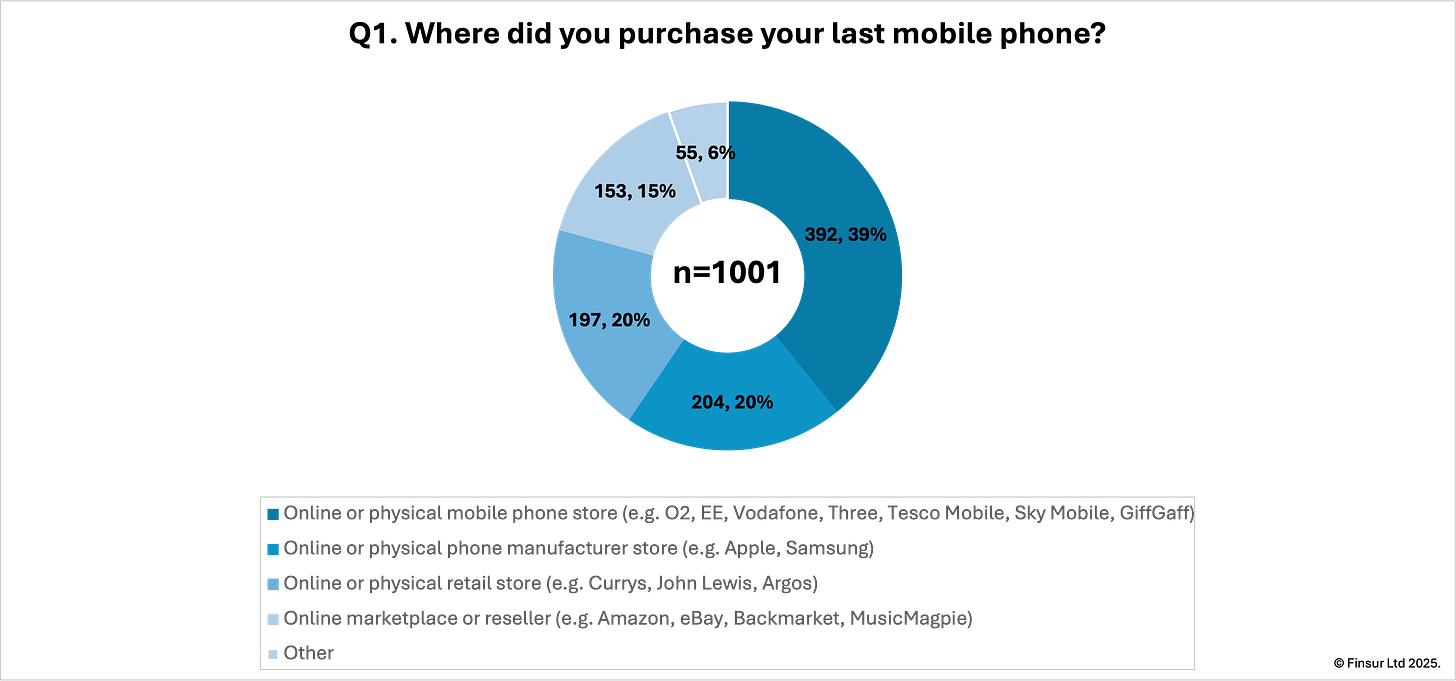

As expected, the telecom stores still captured the largest share of purchases at 39.2%. The combined retail and marketplace channels accounted for 35% of sales against 32% last year. Interestingly, responses indicate that manufacturer store preference dropped from 23% of the share last year to 20.4% this year, although, there is some variance by brand with 24.8% of Apple buyers choosing to bag their new phone directly from Apple, whilst Samsung buyers going direct was 7.6% lower at 17.2%.

Additionally for this year, I split the multi-channel retailers (e.g. Currys, John Lewis, Argos) which captured 19.7% of the market and the online only retailers and marketplaces (e.g. Amazon, eBay, Backmarket, MusicMagpie) who accounted for 15.3% of total sales and 46.1% of all refurb sales, which was to be expected given the question phrasing.

As a footnote, the survey also provided a little insight into the unorganised secondary market with 2.8% of device acquisitions being gifts or hand-me-downs from family members with 0.4% of phones purchased directly from friends. This would take the refurbed / secondhand purchases from 15.4% in the organised market to a total market share of 18.6%.

There were also a couple of side notes for me: 1) Raylo was mentioned, which makes me think I need to add payment method to the next survey; 2) Community TechAid were noted and their mission is worth a click, and; 3) Three clearly have some disgruntled customers unhappy with their replacement devices.

Refurb Market Segmentation

The 15.4% refurbished device share, shows clear segmentation by quality expectations and price tolerance. Quality standards dominate buyer preferences: 63% of refurb purchasers chose either pristine/excellent/very good condition (49.4%) or manufacturer certified refurbished devices (13.6%), with only 4.5% accepting fair or acceptable condition phones. This makes sense. If you’re buying a refurb, you probably want one in the best condition possible.

Price distribution reinforces this quality focus. Among refurb buyers who recalled their purchase price, 63% spent under £400, whilst 21% paid £400 or more, a price point that overlaps with new mid-range devices. The relationship between condition and price shows expected patterns: buyers choosing “good condition” devices skew heavily toward lower prices, while those seeking certified or pristine condition are more willing to pay premium prices. That might mean there are two distinct value propositions in the refurb market. A cohort of budget-conscious buyers trading condition for savings and, quality-focused buyers trading newness for value.

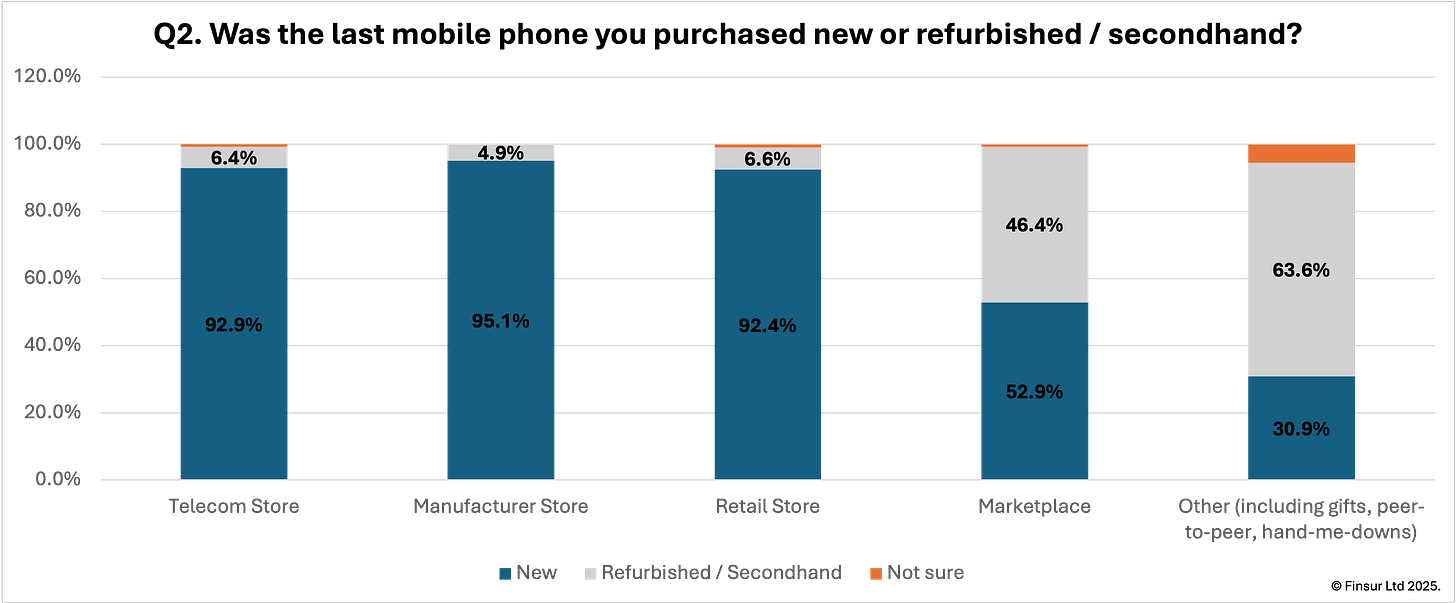

Channel patterns reveal distinct distribution strategies. Traditional retail channels, telco stores, manufacturer stores, and multi-channel retailers all sell refurb devices at low single-digit rates (between 5-7% of their mix), focusing almost entirely on new sales. As expected, the marketplace channel shows a near-even split: 53% new versus 46% refurb, positioning these platforms as the primary formal refurb distribution channel. Companies that have begun to include device collections and sales in their sustainability metrics will need to work much harder to capture their target shares.

Demographics show sustainability attitudes drive refurb adoption more strongly than income. Among buyers citing sustainability as having “a lot of influence” on purchasing decisions, 34% chose refurb devices. This drops to just 11-12% among those citing little or no sustainability influence, a 23 percentage point difference. Income shows a more modest gradient with refurb adoption declining from 18% among those earning under £25k to 11% among those earning over £100k.

Three distinct buyer types emerge from these patterns:

“Premium Refurb” buyers seeking certified or pristine condition devices, often paying £400+, purchasing through marketplaces or manufacturer channels.

“Value Refurb” buyers prioritising price over condition, accepting good or fair condition devices under £400, often through peer-to-peer channels.

“Sustainability Refurb” buyers span both groups but show stronger preference for higher-quality refurb options, suggesting environmental concerns don’t necessarily mean accepting lower quality.

Continue reading for:

Apple’s Refurb Advantage and brand economics analysis

Price Dynamics including the counterintuitive premium buyer replacement pattern

Demographic Analysis and replacement cycle data

Market Implications: lifecycle extension, consolidation thesis, and channel dynamics

Also available as a standalone pdf here.