Market Update: CCS Insights Prediction 36.

I wouldn't bet against it.

I was fortunate enough to get my name down early for this year’s CCS Insights Predictions event. The event itself was excellent. Intense. A bit like drinking from a firehose. But that was the point. Fast-paced, 15 minute presentations and panel interviews giving us a glimpse in to the future and highlighting the breadth and serious depth in expertise across the sector. So, in a nod to an excellent afternoon of information sharing, I thought it might be interesting to take a few of the CCS predictions and figure out what it would take to get there or what things might look like if we do, a bit of scenario development if you like. So in part 1 of a series over the next few weeks here is a possible scenario for CCS Insight’s:

Prediction 36. By 2027, over a third of mobile phone sales in the UK are directly from the manufacturer.

Before the pandemic, this might have had long odds. At some point, we all seemed content buying our phones from carriers and then SIM-only came along and we realised we didn’t have to do that anymore. In the last few years the shift towards buying direct seems to have accelerated significantly. CCS suggest that six years ago, the number of UK consumers buying direct from the manufacturer was 5%. In my device survey last year, 23% of consumers reported buying their last mobile phone from a manufacturer store (online and offline). This year, that number fell back to 20% matching the current CCS Insights estimate.

Setting the Baseline

So, what does a third of mobile phone sales look like? I’ve previously established the case for a UK market contraction1, therefore I’ll continue to assume that’s the case, which means in 2027, I estimate the UK market will be roughly 16.5m unit sales made up of 13.7m new unit sales and 2.8m refurbished devices. 33% would mean the manufacturers selling 5.4m devices directly. However, given the current category sales, it’s unlikely that the future new / refurb category split is going to even out within two years. It’s more likely that the manufacturers will continue to accelerate their position in new device sales (let’s say around 35% or 4.8m units) while building a meaningful share in certified refurbished (let’s say around 23% or 0.6m units).

As it stands, device manufacturers are capturing 20% of all device sales. Overall, for new devices it’s a little over 23%. Apple buyers go direct at 24.8% and Samsung buyers go direct at 17.2%. That’s one in four Apple buyers already bypassing the traditional retail route. Considering refurb only, the manufacturers at a 6.5% share or approximately 0.2m units, have a marginal presence compared to the marketplaces who dominate at 46% of refurb sales.

The 2027 Target State

Getting to a 35% share from 23%, would mean the manufacturers increasing new units from 3.3m to 4.8m, that’s 45% growth or in unit terms, an additional 1.5m new device sales. For refurb, that’s growing from 0.2m to 0.6m units, 0.4m in real terms and a 200% growth in share.

Individually, the target suggests Apple would need to hit a 38% direct penetration from their current 24.8% baseline which involves selling an additional 0.7m units, from 1.5m currently to 2.2m units in 2027. Adding a new target of 0.3m refurbished units, takes Apple’s total direct sales target to 2.5m devices. Samsung’s unit target feels equally tough. Hitting a required 32% from their 17.2% starting point involves generating 1.6m in new unit sales from 0.9m currently. Add in approximately 0.2m in certified refurbished sales and that Galaxy Club pilot is going to have to scale considerably to achieve 1.8m total sales. If I didn’t assume an additional 1.1m units from all the other manufacturers, I’d have to rely on the duopoly to hit even higher targets and in reality, I’m only expecting Google to pick up some of the slack. Their 9.3% manufacturer direct sales from a 6.9% overall market share is the only other decent baseline from which to start.

These numbers are going to rely on further circular integration. Manufacturers achieving 35% share of sales might also require hitting trade-in rates around 45%-50% with a significant percentage of those devices earmarked for certified refurbished programs with a controlled secondary sale through their direct channels. All this assumes that more customers will be staying in the manufacturer ecosystem throughout the complete lifecycle. That additional loyalty would come at some cost, not only to the manufacturers themselves, but to everyone else in the market.

Who Pays the Price?

Remember, this is a scenario and as such, I’m assuming, and it’s a big assumption that there’s a limited or ineffective competitive response to the manufacturers gaining 1.9m additional unit sales (1.5m new / 0.4m refurb). But, in a contracting market, that means someone is going to lose out significantly.

Whilst they’re still the biggest distributor of devices in the UK with a 38% market share, approximately 93% of their device sales comes from new units. That’s the largest pool in unit terms from which the manufacturers can pluck. The full CCS prediction questions the operators’ role in the purchase process and, with eSIM, SIM only economics and trade-in programs like the Galaxy Club offering significant value return to the customer, there’s a host of drivers working against them. As the primary victim, the telcos could lose approximately 1.3m units. The hit would be amplified by losing the trade-in business as well.

It’s unlikely multi-channel retailers would be spared either. Removing 0.8m new units would reduce their market share from 20% currently to approximately 15% in 2027. The overwhelming majority of their sales are new units (95%) with their online channels adding 5% of refurbished unit sales. Despite the recent European trend of refurbished sales coming offline and into stores2, it would be extremely difficult for UK multichannel retailers to secure the stock levels required to fulfil the same proposition consistently. That would be a shame given the benefits of getting high quality refurb devices under the consumers’ keen eyes.

The marketplace channel, responsible for 46% of refurb sales or approximately 1.2m units would be the most likely place to lose sales in that category. This could drop to approximately 1.0m units or a 35% market share. Let’s not forget that Amazon the Almighty are a significant distributor in the UK market3 and their material market share may place them in line for some direct competitive action. That battle would certainly be worth settling into the armchair with a box of popcorn or two.

The Control Mechanism

So, how would the manufacturers achieve such a shift? In this scenario, successful trade-in programmes would matter enormously. Take the current new to refurb ratios. The manufacturers sell 6 refurb devices for every 100 new devices. The 2027 target would mean 12-13 refurb devices for every 100 new. So, whatever reverse logistics, grading, wiping, refurbishing and recycling processes are in place today, they would need to handle double the capacity in 2 years time. Feasible, and I’m sure the manufacturers’ partners are up for the business, but still significant. It feels like the automation discussions at the Circular Summit, the day before the CCS Predictions event, are redundant. Automation would be absolutely necessary and as much of it as possible. Apkudo, FutureDial et al I’m sure will be looking ahead in anticipation. Similarly, Likewize may be on Apple’s coattails but they’re certainly sitting pretty4.

Whilst current manufacturer trade-in rates are strong, 44% of Apple buyers and 40% of Samsung buyers trade-in5, destination is going to matter. Flows to partners, aggregators or bulk sales would need to be adjusted as the manufacturers retain more stock for direct sales. Incoming channels matter too. With a physical store footprint being a key driver in consumer trade-in rates, Apple would maintain a distinct advantage over their rival.

Samsung’s response may depend on the success of the Galaxy Club pilot which strengthens their trade-in advantage in the 1-2 year window by targeting 12-15 month old phones. Once established, adjusting the term or the guaranteed residual value levers should be simple enough experiments to further maximise trade-in rates. Apple on the other hand, can rely on their higher overall trade-in activity across a far longer time period. Whether older devices marketed as certified refurb makes economic sense, is the additional question they have the luxury of grappling with. Estimating volume here is a bit more challenging, but let’s assume 4.8m direct new sales with a 42% average trade-in rate gives us approximately 2.0m trade-ins captured. That means keeping hold of 30-35% to service the 0.6m target.

There are some complementary drivers. Take residual value management. Samsung’s Galaxy Club is an example of supply control, fewer devices going to marketplaces keeping prices high. Customer data: maintaining ever closer direct relationships and actively managing the customers’ consideration set as they enter their upgrade windows. ESG credentials: how sustainability reporting plays out is really anyone’s guess. Ultimately there will be some simplification, but who would be better placed to capitalise on that than the manufacturers.

What Might it All Mean?

The obvious conclusion to draw directly from the CCS prediction is that the manufacturers are about to turn the screw on the device market. But, it’s not just about selling more. To use a nauseatingly convenient pitch term, it’s about getting the “circular” flywheel (tautological, I grant you) spinning to sell a device, buy it back, certify its quality and sell it again. Repeat as many times as possible. Manufacturers will want to control 33% of device lifetimes, not just sales. And, looking at it like that, a third of the market might end up being the minimum.

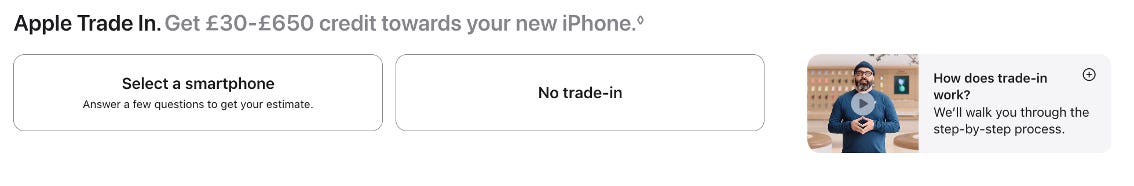

Apple looks well prepared for the next few years. Their physical store footprint would be a critical advantage making in-person trade-in as smooth as picking up a coffee. In fact there’ll probably be one waiting for you. The May survey that put trade-in at 44% for Apple buyers is already the highest in the market6. The offer is straight forward, the process is slick and the value proposition is easy to grasp. The iPhone Upgrade Programme, despite the limited scale, was an early indication of Apple’s taste for recurring, direct relationships. Add in the trusted premium brand status and the jump from 24.8% to 38% direct seems less of a leap and more a measured stride by spinning the existing flywheel a bit faster.

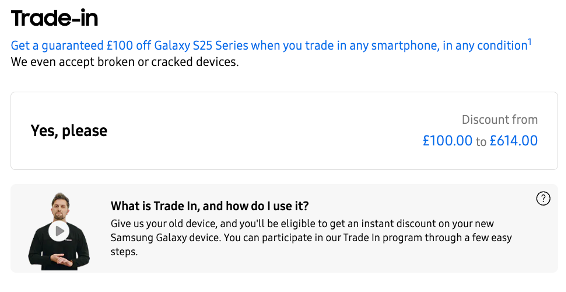

Samsung, meanwhile, are playing catch-up without the luxury of a high-street presence. Instead they will be relying on programmes like the Galaxy Club to plug the gap. It seems bold, but it hits the sweet spot where Samsung owners are most likely to flip, 12-15 months, then bait the hook with a guaranteed value. The payoff is fresher devices, better inventory and maybe even a few points of closure on the residual value gap with Apple. The structure works on paper, but scaling a pilot to a national engine by 2027? That’s a real test. It feels like a lot to ask, but if they pull it off, a near doubling of their direct share isn’t outlandish.

Despite this prediction landing firmly on the duopoly’s shoulders, the consequences would ripple far beyond the two headline brands. As the manufacturers tighten their grip on the device lifecycles, every extra turn of their flywheel deprives the carriers, third-party retailers and marketplaces of both sales and supply. The old model of devices thinly traded throughout a sprawling ecosystem of trade-in specialists, repair outfits, sellers and marketplaces would come under intense pressure. That ecosystem, which thrives on friction and fragmentation would face an imminent future of forced partnerships, shrinking margins and regular readers won’t be surprised, outright consolidation. Those that remain will need scale, efficiency and tight vertical integration simply to stay in the game.

In this scenario then, the narrative for the next few years would be reshaped by this gravitational pull with secondary market players banding together, merging or disappearing entirely as the manufacturers streamline and lock down both ends of the ownership cycle. In short, if the wheel spins up as CCS predict, the old fire and forget device market will be long gone with fewer larger players left standing at the centre. Do I agree with this CCS prediction? Yes, I wouldn’t bet against it and if this is the type of discussion that floats your boat, be sure to download the 2026 Predictions Booklet.

Peace,

sb.

Over the next few weeks, I plan to inject the regular research updates with similar articles on the following CCS Predictions:

Prediction 59: By 2029, the organised secondary market accounts for 40% of second-hand device sales globally.

Prediction 60: More than 80% of second-hand smartphones sold in the organised secondary market in Europe are sourced from within the continent by 2030.

Prediction 62: By 2026, one in four launches of premium smartphones comes with buy-back or upgrade offers.

Ibid.