Market Update: CCS Insights Prediction 60.

Europe's Retention Complex: A Behavioural Analysis

So far in this series I’ve covered CCS Insight Predictions 36 and 62 which offered a couple of scenarios in which manufacturers direct mobile phone sales in the UK hit at least 33% by 2027 and that 25% of all premium smartphone launches come with buy-back or upgrade offers. With manufacturers currently at 20.4% of new sales in the UK, there’s some way to go but by securing control over the lifecycle, it’s easy to imagine the traditional buying routes through telcos could lose further ground.

Although Samsung’s summer experiment with their Galaxy Club 50% value guarantee appears to be on a temporary hiatus, Apple’s China Upgrade Programme and their well-tested European Trade-in infrastructure provide the consumer data and backbone to rapidly spin up their circular flywheel with telcos and traditional retailers losing out in new sales.

However, these Predictions are scenarios and should not be considered a foregone conclusion. Research into Currys Retail (Carphone Warehouse) and AO World demonstrated that competition is alive and well. AO’s Switch24 proposition for their Five Star club members introduces an innovative method of separately financing the depreciation and residual value, offloading some of the latter risk to the consumer. Still, whatever channel you happen to be in, phone supply might still be an issue which brings me to:

Prediction 60: More than 80% of second-hand smartphones sold in the organised secondary market in Europe are sourced from within the continent by 2030.

The full prediction text goes like this: “The proportion of imported second-hand smartphones drops from 50% to less than 20% as regulations restrict the flow of devices from outside Europe. Players in the organized secondary market ramp up trade-in programmes and buy-back schemes to ensure a more consistent and reliable supply of devices for the European market.”

Setting the Baseline

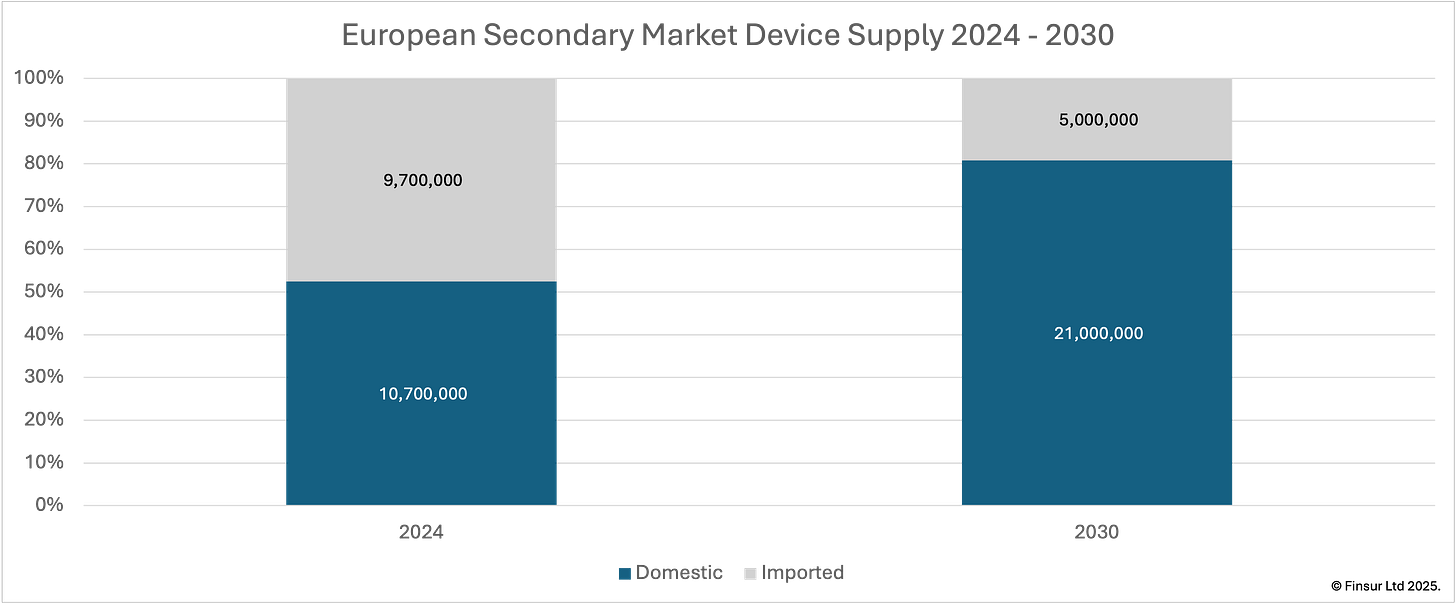

According to CCS, Europe’s 2024 organised secondary market came in at 20.4 million units with 52% (10.7 million units) domestically sourced, versus 48% (9.7 million units) being imported in order to meet demand. Whilst the secondary market in smartphones has been growing at a decent clip, 6.1% CAGR between 2021 and 2024, the forecast for 2025 stalls dramatically with 1% growth expected. This reflects my own primary research from October this year that saw UK consumer appetite for refurbished devices decline slightly to 15.4%1.

However, I’d like to assume some growth out to 2030 and would suggest conservatively that 3.5% annually from 2026 reflects consumer appetite across Europe and increased participation from manufacturers with telco, retail and marketplace channels not letting them have their cake without a few slices missing. Using 3.5% over 6 years gives us a growth multiplier of 1.229 meaning the 2030 market size would come in at 25.1 million refurbished units in the organised secondary market. This would mean the CCS 80% prediction involves 20.1 million units sourced domestically and 5.0 million units imported. In percentage terms this means that domestic sourcing needs 88% growth and corresponding imports would fall 28%. Spicy.

The Retention Problem

Compared to our American cousins, it might not be the first time us Europeans have been regarded as retentive. But, in this instance, I’ve got the Eurostat data to back it up. According to the stats, 51% of European consumers keep old devices at home rather than disposing or recycling them. Apparently in 2024, Ireland (69.3%), Cyprus (66.8%) and Sweden (61.9%) were the highest hoarders, with Albania (24.9%), Turkey (36.1%) and Montenegro (37.2%) having the lowest tendency to keep smartphones within their households. Germany (45.5%), France (54.9%), Spain (61.7%) and Italy (49.3%) showed some variation around the EU27 mean (51.2%). From the seminal 2019 study by Vasileios Rizos et al for the European Economic and Social Committee, the estimated number of phones hibernating amounted to almost 700 million2. That was over 6 years ago.

Last year Vodafone suggested that over 200 million devices were retained by Brits, three per household3, whilst VMO2 put the UK number at 123 million this year4. A GSMA report from last year highlighted the behaviour is not limited to Europe, with 75% of consumers globally continuing to store at least one old device with approximately 5-10 billion used phones remaining dormant worldwide5. The numbers are big and the problem is systemic.

So, Europe has the devices on hand to meet, and easily surpass, the 80% target. The problem is those phones are not moving into organised channels and the 10.7 million devices currently sourced domestically represents only a fraction of those hibernating. To hit 20.1 million domestic units by 2030, Europe would need to mobilise an additional 12.7 million units from households or double the current extraction rate from the installed base. It was over a year ago that I suggested levering out UK drawer phones might become a speciality6. But whilst market forces haven’t bridged the gap as yet, extensive European research reveals distinct barriers, each with addressable solutions.

Behavioural Barriers

Back Up

According to a Vodafone Institute study across multiple European markets7, 47% of consumers cited that they intended to keep their old phone as a back-up or spare device. An insurance option, if you like, against their new device failing, being damaged, lost or stolen. It’s rational risk management when a new phone might be setting you back in excess of £800/€900 and repair turnaround times might be up to a week with additional expense.

However, I’m inclined to question this reality. Anecdotally, despite the occasional bendy mishap, device durability and quality improve year on year. Manufacturer warranty reserves are usually around the 2% of sales mark and according to the latest FCA General Insurance Value Measures data, insurance claim rates are less than 8% (for those insured, annually)8. Even though many of us might walk around with a cracked screen, consumers in general don’t appear to rationalise actual experience, instead performing some type of functional utility calculation that guaranteed connectivity is worth more than the value of a trade-in offer.

There’s also the hassle factor. Having a spare in the drawer might be more about the time saved and the control retained when disaster strikes. The consumer without a backup faces an immediate connectivity crisis: out of touch, unable to bank, having to research repair or replacement options without regular phone access, trips to shops, waiting for a diagnosis, and so on. The consumer relies on the drawer phone to eliminate that panic. Power it on, swap the SIM, restore basic connectivity within minutes and, all being well, take your time to consider repair/replacement options. Current trade-in programmes are asking consumers to surrender this optionality for well, in the case of my iPhone 12, £65.

Loaner phones and advanced exchange replacements, have been on and off features of insurance policies trying to bridge this gap. However, the additional inventory, logistics and fraud expense have meant the service has never been widely adopted in Europe beyond premium packages or VIP customers. Alternatively, subscription models with guaranteed continuous device access have the consumer touch points to render the backup device redundant. Insurance of course offers a great opportunity to solve the problem but might need to adjust positioning, explicitly stating that “you no longer need a backup, so trade it in”. The larger specialists (Assurant, Asurion, Likewize & SquareTrade) and challengers like Bolttech with their integrated offers are well placed to support their clients improving better front-end communication to consumers.

But, there’s no doubt this is a difficult behaviour to address. Perhaps consumers just need regular reminders their phone fears rarely materialise. So take a look at your marketing messages and remind them. There’s little to lose when backup anxiety affects an estimated 60 million device replacements annually across Europe. That’s nearly five times the 12.7 million devices needed to achieve 80% domestic sourcing by 2030.

Privacy & Security

Not too far behind the backup rationale comes consumer fears over data privacy and security. This anxiety operates as a silent veto: even when financial incentives are attractive, data concerns block disposition. The barrier goes beyond not knowing how to wipe a device, there’s fundamental lack of education and/or mistrust in third-party handling and chain-of-custody.

On average across the Vodafone study, 16% of customers cited data concerns as the primary retention reason9. UK consumers showed heightened anxiety at 32%10. In addition to the mistrust, there’s a genuine knowledge gap with 13-17% of consumers claiming they don’t know how to wipe data properly. Among those who do understand, 11% found it too arduous. The paradox is that industrial erasure capability is widespread and often in use in all the main channels. But, it needs to be consumer friendly, transparent and educational. Despite secure data erasure being front and centre on almost all of the major buyer sites…

…it means little without some background knowledge of standards or tools and naming your erasure partner will mean little to the average consumer…

Certified erasure needs to be mandated for every device at every collection point with consumers receiving an SMS or email in plain language explaining the overwrite process and confirming data unrecoverability, plus a link or QR code to the audit record. Alternatively, manufacturer certified apps could be run by the consumer before surrendering their device. After a compliant wipe, the customer must be able to retain permanent proof that their data has been destroyed before their device leaves their possession. This could significantly reduce the levels of mistrust in the system: the customer controls the wipe, has the proof and then trades in a clean device. It would address the don’t know how and the don’t trust the system barriers.

Let’s face it, NIST SP 800-88, ISO/IEC 27001, and the raft of European national standards mean nothing to consumers. But translating industrial-grade security into consumer-visible proof, through mandated certificates, plain-language summaries, and perhaps a government-backed awareness campaign, could be well worth the effort. Data anxiety affects 20-41 million European trade-in decisions annually. Make the invisible visible.

Value Perception

Between any buyer and seller, there’s always a value gap. Trade-in offers can feel insultingly low relative to the original purchase price. The UK launch price of an iPhone 15 Pro 256GB was £1099. Just over two years later, as long as you’ve kept the phone in good condition, Backmarket are offering £405 and £359 if it looks used. Refurbed would give you €482 and Swappie about €472. That’s a 63% value loss for good condition or 67% if it shows normal wear and tear.

French research shows up to 50% of replaced phones are kept for potential reuse rather than accepting what feels like modest compensation11. Rightly or wrongly, market forces dictate the perception that the residual value exceeds what’s being offered. Add the effort required, data wiping, factory reset, condition proof, label printing, posting, waiting for payment, suddenly the £405 doesn’t offset the hassle. UK consumers confirm this with 25% “never get around to it” and 16% find it the hassle factor too much12.

The grading process can compound the problem for buyer and seller. Online valuations being self-reported may not match the market reality. The £405 quote could reasonably become £359 because consumers don’t understand the grade boundaries. Worse still are the unscrupulous bait and switch tactics often alleged by consumers. Webuyanphone address this buy videoing their grading process for individual phones, which may not always assuage the valuation gap, but at least there’s transparent evidence of their grading rationale. It should also be recognised that some consumers will try their best to maximise the value of their devices, although on a recent industry panel, Craig Smith at Mazuma suggested for the most part interactions were pretty honest.

Three interventions might shift the calculation. First AI-powered visual assessments could provide instant locked valuations at retail collection points, either from staff or via kiosks. Get your device scanned, approve the real-time condition assessment and binding price and walk out with an immediate payment. ecoATM and GetRE are well down this path, but European rollout is slow with Orange starting a pilot earlier this year. Branded Mazuma, WeBuyAnyPhone, Swappie, Rebuy, etc. kiosks would support widespread adoption and go a long way to reducing the grading trust deficit.

Second, psychological reframing through transparency. Rather than highlighting the 63% depreciation from purchase price, experiment with offer price ranging. Setting a lower limit but with an average value paid might help better manage consumer expectations. Show what the device contains: £8.50 of recoverable cobalt, £2.30 gold, £6.20 copper could frame the offer as “recovering 85% of remaining material value” instead of “accept 37% of purchase price.” Add time-decay urgency, ”this device loses £5 in value each month”, and whilst I’m not the biggest advocate, credible environmental impact quantification could help to sway some consumers.

Third, guaranteed trade-in values locked at purchase. Samsung’s Galaxy Club already demonstrates this model, offering guaranteed buyback values at point of purchase. AO World’s Switch 24 program provides similar certainty: fixed trade-in values locked in when you buy, removing market uncertainty from the equation. As explored in the Article 2 analysis for Prediction 62, one in four premium smartphone launches by 2026 are expected to include such buy-back guarantees. This would transform the psychology: trading in feels like recovering “your money” rather than accepting whatever the market offers at an uncertain future date.

The Friction Trio

Beyond backup anxiety and data security, the dominant psychological barriers, three secondary factors compound retention. European research shows that 17% of consumers don’t know what to do with their old devices and 11% cite the effort involved as a barrier to doing anything with them13. UK data reveals that 25% of consumers just never get around to doing anything and 33% forgot about their devices14. The small form factor might have something to do with the procrastination: no storage pressure, no urgency. There’s also a sentimental attachment averaging 13% across European (with 20% amongst Gen-Z) where devices become proxies for photos and memories, and the lingering anxiety that not everything transferred properly. Layer in awareness gaps: consumers underestimate residual component value, don’t understand the environmental impact of hoarding critical materials, and remain unaware of collection options beyond manufacturer programs. Irish research identifies “critical moments” for divestment: moving house, major decluttering, unemployment,15 but outside these life transitions, devices simply don’t enter disposition consideration.

Solutions are likely to be found in getting closer to the customer and increasing their awareness of lifecycle options. Manufacturers and carriers already have valuable touch points with their consumer apps. Retailers less so. Apps could include: automatic return programme enrolment at purchase; real-time residual value tracking with optimal trade-in notifications; one-click (well, maybe two or three) data wipe with certificates; instant valuation with links and QR codes for return instructions; immediate payments to linked accounts and; loaner device requests for long repairs. For sentimental attachment, perhaps there’s a way of separating the emotional from the physical. For Gen Z’s heightened nostalgia, social media device journeys, your “iPhone 15 Pro 256GB Wrap” or gamified trade-in streak badges redirect attachment psychology towards disposition. Retail infrastructure completes the solution with walk-in assessments and payments in under 5 minutes, addressing the 17% who don’t know and the 25% who never get around to it.

Policy Nudges

There’s enough under the umbrella of the EU Circular Economy Act 2026 to keep the compliance teams busy for a number of years and if you’re interested, I’ve covered it in some depth here. But, there are some policy nudges that could make a difference by focusing on consumer adoption rather than more SME regulation:

Offer meaningful tax incentives for trading in older devices. I know there many challenges around VAT in the secondary market, but changing systemic behaviour is hard and needs meaningful policy. How about reducing VAT by 5 percentage points for 7-10 years (two replacement cycles) on the new device when trading in an old one, regardless of the trade-in value. Whilst the governments forgo a portion of revenue, consumers get a tangible benefit and it’s light touch for SMEs.

Have governments fund awareness campaigns at critical moments. Target ads during house moves, decluttering season, January, the new year purge. Be honest about the value of drawer phones and how they can contribute to the circular economy. Link to comparison sites showing all available trade-in offers.

Governments should also fund a public data security education campaign. Explaining what to look out for when trading in devices. Videos of the process, make the existing capability visible and trusted through government endorsement.

And one person’s request to the UK Circular Economy Taskforce: please just align with existing and future European regulation when it comes to circularity in consumer electronics. Nothing more and nothing less.

Summary

The 80% domestic sourcing target by 2030 requires mobilising 12.7 million dormant household devices whilst reducing 4.7 million imported units. This series of articles reveals one thesis: manufacturers industrialising device lifecycle control. Article 1 showed direct sales capturing customer relationships (1/3 UK mobile sales by 2027). Article 2 demonstrated buy-back offers locking in returns at purchase (25% of premium launches by 2026). Article 3 shows how behavioural barriers block household mobilisation: backup anxiety affects 60 million annual European replacements; data security concerns 20-41 million; while compound EU regulations create import friction.

No single intervention is likely to deliver 80%. Success requires manufacturer programmes scaling pushed by competitor responses, consumer-facing policy nudges (VAT incentives, awareness campaigns, data security education), and market innovation eliminating trade-in friction. The circular flywheel is spinning up. Whether domestic sources can scale fast enough by 2030 becomes a key question. If you’re positioned to influence this value chain, now’s the time.

Peace,

sb.

https://www.mobileworldlive.com/gsma/gsma-spotlights-phone-recycling-trends/ . Note this report also states that the used phone market is projected to eclipse new smartphone sales in years to come, I think based on the annual growth data. I expect more from the GSMA. Do your maths.

See note 3.

See note 2.

See note 3.

See note 9.

See note 3.

See note 2.